The U.S. Court of Appeals for the Second Circuit recently affirmed the dismissal of an action by the trustee of a residential mortgage-backed securities trust for breach of contractual obligations to repurchase mortgage loans that allegedly did not conform to representations and warranties, holding that: (1) the breach of contract claim was barred by the statute of limitations, which ran from the date the representations and warranties were made; (2) the so-called “extender provision” of the federal Housing and Economic Recovery Act did not apply to the trustee’s claim; and (3) the trustee’s claim for breach of the implied covenant…

Posts published in “Mortgage Banking Foreclosure Law”

Mortgage Banking Foreclosure Law

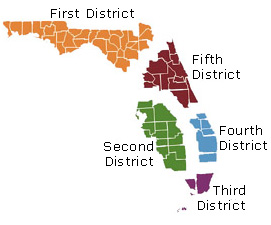

The District Court of Appeals of the State of Florida, Fourth District, recently reversed final judgment of foreclosure in favor of a mortgagee for entry of judgment in favor of the mortgagors, where the mortgagee failed to prove that it came into possession of the note containing an undated, blank endorsement before the foreclosure was filed. In so ruling, the Fourth District confirmed that a trial court abuses its discretion in admitting business records if it is not established that the records were made at or near the time of the event. In addition, the Fourth District held that a…

The Appellate Division of the Fifteenth Judicial Circuit of the State of Florida recently reversed dismissal of a federal Fair Debt Collection Practices Act (FDCPA) claim alleging a debt collector’s letter falsely represented a bank was the creditor of a loan. In so ruling, the Appellate Division confirmed that even though a foreclosure action is not necessarily debt collection, the enforcement of a promissory note constitutes debt collection activity even if done in conjunction with the enforcement of a security interest, and even the debt collector stated it was seeking solely to foreclose the creditor’s lien on the real estate,…

The U.S. Court of Appeals for the Fifth Circuit recently affirmed summary judgment in favor of a loan owner and its loan servicer because the servicer gave the required 20-day notice of default under the Texas Property Code prior to initiating foreclosure, and the borrower failed to allege violations of the Texas Debt Collection Act (TDCA). A copy of the opinion in Diana Rucker v. Bank of America, N.A., et al is available at: Link to Opinion. The borrower obtained a $175,000 loan in 2005 in order to purchase her home, signing a note and deed of trust. The deed of…

The Maryland Court of Appeals recently affirmed a trial court’s grant of summary judgment in a putative class action “application fraud” case in favor of a mortgage company, bank, loan officers, realtors and a realty group and against the putative class of borrowers. In so ruling, the Court held: (1) the borrowers’ allegations were time barred; (2) the borrowers were put on inquiry notice and presumed to know the contents of the fraudulent loan applications they signed; (3) the lenders and realtors were not shown to have prevented the borrowers from reading the application documents; (4) the lenders had no…

The District Court of Appeal of the State of Florida, Fifth District, recently reversed a final judgment of foreclosure in the mortgagee’s favor, holding that based on the default date alleged in the complaint, the default date alleged in a prior foreclosure suit as to the same loan, and the dismissal without prejudice of the prior foreclosure action, the mortgagee’s foreclosure claim was barred by Florida’s five-year statute of limitations. However, in so ruling, the Fifth District also held that the mortgagee was “not precluded from filing a new foreclosure action based on different acts or dates of default not…

The U.S. Court of Appeals for the First Circuit recently held that a failure to file a probate claim does not extinguish a mortgage lien under Rhode Island law. In so ruling, the Court held that “the piper must be paid.” A copy of the opinion is available at: Link to Opinion. The plaintiffs, a brother and sister, inherited their mother’s house. During her lifetime, the mother had taken out a reverse mortgage secured by the house. The mortgage securing the loan contained an acceleration clause and power of sale and became due and payable upon the mother’s death. The…

The District Court of Appeal of the State of Florida, Fifth District, recently reversed the entry of a judgment in favor of two borrowers in a foreclosure action, and confirmed that a current servicer does not need to present testimony from an employee of a prior servicer in order to admit the business records of the prior servicer into evidence at trial. A copy of the opinion is available at: Link to Opinion. The borrowers obtained their mortgage loan in 2006. They defaulted, and the prior servicer brought a foreclosure action in 2009. At that time, the borrowers sent a…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure where a substituted plaintiff failed to prove the original plaintiff had standing when suit was filed. In so ruling, the Appellate Court confirmed that it is not enough for a plaintiff to prove standing when the case is tried, it must also prove standing when the complaint was filed. A copy of the opinion is available at: Link to Opinion. A mortgagee initiated a residential foreclosure action after borrowers defaulted, and the borrowers responded that the mortgagee lacked standing. An assignee was then substituted…

The Court of Appeal for the Third District of the State of Florida recently held that the trial court had subject matter jurisdiction to hear a common law action to recover a deficiency judgment after an earlier residential mortgage foreclosure action in the same court was already completed. The Court reasoned that the applicable statute expressly provided for such a common law action, and although the foreclosure judgment reserved jurisdiction to adjudicate any claim seeking a deficiency, it neither granted nor denied it. A copy of the opinion is available at: Link to Opinion. A mortgage loan servicer obtained a…

The U.S. District Court for the Middle District of Florida recently confirmed that Florida’s statute of limitations did not bar a mortgagee from filing a new foreclosure action based on non-payment or other kinds of defaults within the past five years, even where the prior foreclosure action was dismissed without prejudice and acceleration of the mortgage occurred more than five years prior to the second foreclosure action. In so ruling, the Court dismissed an amended complaint for declaratory judgment seeking to invalidate a mortgage. A copy of the opinion is available at: Link to Opinion. A property owner sought a…

The Second District Court of Appeal of the State of Florida recently affirmed an award of attorney’s fees and costs to two borrowers, even though the borrowers moved for fees and costs more than 30 days after the mortgagee filed a notice of voluntary dismissal that was expressly made conditional upon the parties “agreeing to pay their own attorneys’ fees and costs.” In so ruling, the Appellate Court confirmed that a conditional notice of voluntarily dismissal was ineffective to commence the 30-day period within which to move for attorney’s fees and costs under Florida law. A copy of the opinion…