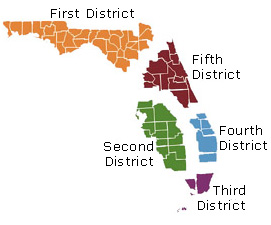

The District Court of Appeal of the State of Florida, Fourth District, recently reversed a final judgment in favor of a borrower based on an alleged oral modification of the mortgage and the doctrine of promissory estoppel, holding that because the mortgage fell within the statute of frauds, it could not be orally modified, and that the trial court misapplied the doctrine of promissory estoppel. A copy of the opinion in Ocwen Loan Servicing, LLC v. Jean Marie Delvar a/k/a Jean Delvar, et al. is available at: Link to Opinion. A mortgagee sued to foreclose in April 2008. The borrower’s answer raised…

Posts published in “Mortgage Banking Foreclosure Law”

Mortgage Banking Foreclosure Law

The U.S. Court of Appeals for the Sixth Circuit recently confirmed that a servicer and loan owner who did not bring a debt collection or foreclosure action as a counterclaim to a federal Fair Debt Collection Practices Act (FDCPA) lawsuit did not waive their ability to collect on the debt in the future. A copy of the opinion in Bauman v. Bank of America, NA is available at: Link to Opinion. In August 2004, the borrowers obtained a loan and executed a note to purchase property. The note was secured by a mortgage on the property. Later that year, the loan was…

The U.S. Court of Appeals for the Ninth Circuit recently held that a 2009 amendment to the federal Truth in Lending Act (TILA), codified at 15 U.S.C. § 1641(g), which contains disclosure requirements for the sale or transfer of a mortgage loan, does not apply retroactively. A copy of the opinion in Mohammad Ali Talaie et al. v. Wells Fargo Bank NA et al. is available at: Link to Opinion. The plaintiff homeowners brought a putative class action against two banks alleging violations of various federal and state laws and alleging claims arising out of the modification of the deed of trust…

The U.S. Bankruptcy Court for the Middle District of Florida recently overruled a debtor’s objection to a mortgagee’s secured claim and denied the debtor’s motion to determine secured status, holding that the issues should have been brought by adversary proceeding, and in any event neither Florida’s statute of limitations nor its statute of repose barred enforcement of the note and mortgage. A copy of the opinion in In re Anthony is available at: Link to Opinion. A mortgagee filed a mortgage foreclosure action in Florida state court in 2009. The complaint contained a paragraph accelerating the note. The mortgagee also…

The District Court of Appeal of Florida, Second District, recently dismissed the appeal of a foreclosure judgment by a third party purchaser of the collateral property, where the third party purchased the collateral property while it was the subject of a foreclosure proceeding and a recorded lis pendens. In so ruling, the Appellate Court confirmed a third party purchaser had no standing to appeal a final judgment of foreclosure where the purchaser did not appeal a prior denial of its motion to intervene, even though the third party purchaser’s name was erroneously placed in the style of the uniform final…

The District Court of Appeal of the State of Florida, Fifth District, recently held that the trial court erred by denying the borrower’s motion to involuntarily dismiss a foreclosure action, because the plaintiff mortgagee’s counsel failed to properly introduce evidence to reestablish the lost note, prove that it had standing to foreclose, prove the amount owed, and demonstrate compliance with the mortgage’s condition precedent of giving notice of default. A copy of the opinion in Figueroa v. Federal National Mortgage Association, etc., et al is available at: Link to Opinion. A servicer foreclosed alleging that the borrower defaulted under the note by failing…

Florida’s Third District Court of Appeal recently reversed a trial court’s mortgage foreclosure judgment against non-signatory co-owners, holding that ratification did not apply where the non-signatory owners received no benefit from the loan proceeds and did not authorize an attorney-in-fact to sign the mortgage on their behalf. In so ruling, the Appellate Court rejected the mortgagee’s efforts to impose an equitable lien on the collateral property. A copy of the opinion in Wells Fargo Bank, N.A. v. Clavero, et al. is available at: Link to Opinion. In October 2005, a mother and father, who had purchased their home more than 30 years…

The U.S. Court of Appeals for the Fifth Circuit recently rejected common law fraud and fraudulent inducement allegations brought by two borrowers arising from their default on a mortgage loan. In so ruling, the Fifth Circuit affirmed the district court’s order granting summary judgment in the mortgagees’ favor due to insufficient evidence of damages, and held that alleged misrepresentations in the course of loan modification efforts did not increase the arrearages as the arrearages would otherwise have been due under the terms of the mortgage loan. A copy of the opinion in Ronald Lawrence, Jr., et al v. Federal Home Loan…

The District Court of Appeal of Florida, Second District, recently affirmed the trial court’s denial of a third party record title holder’s motion to cancel a mortgage foreclosure sale, even though the third party movant acquired title in a prior homeowners association lien foreclosure action, and even though the third party movant alleged that the mortgagee thwarted its redemption rights by supposedly failing to provide an estoppel letter. A copy of the opinion in Whitburn, LLC v. Wells Fargo Bank, N.A. is available at: Link to Opinion. In December 2012, a mortgagee filed a foreclosure action along with a lis pendens against…

The U.S. Court of Appeals for the Eighth Circuit recently affirmed summary judgment against the seller and originator of mortgage loans and in favor of the purchaser because the originator breached the purchase and sale agreement by refusing to cure or repurchase eight of the 11 loans. A copy of the opinion in CitiMortgage, Inc. v. Chicago Bancorp, Inc. is available at: Link to Opinion. The plaintiff mortgage loan investor purchased mortgage loans originated by the defendant lender in 2004. The plaintiff’s business involved re-selling most of its loans to other investors in the secondary mortgage market. The purchase and sale agreement required the…

In a case addressing what it means to “surrender” property under the Bankruptcy Code, the U.S. District Court for the Southern District of Florida recently held that a Chapter 7 trustee’s abandonment of real property only restores legal title to the debtors as if no bankruptcy petition had been filed, and does not also give the debtors the right to contest the mortgagee’s foreclosure if the debtors elected to surrender the property. A copy of the opinion in Failla v. Citibank, NA is available at: Link to Opinion. Husband and wife debtors defaulted on their mortgage and the mortgagee sued to foreclose.…

The U.S. Court of Appeals for the Second Circuit recently affirmed the dismissal of an action by the trustee of a residential mortgage-backed securities trust for breach of contractual obligations to repurchase mortgage loans that allegedly did not conform to representations and warranties, holding that: (1) the breach of contract claim was barred by the statute of limitations, which ran from the date the representations and warranties were made; (2) the so-called “extender provision” of the federal Housing and Economic Recovery Act did not apply to the trustee’s claim; and (3) the trustee’s claim for breach of the implied covenant…