The U.S. Bankruptcy Court for the Southern District of Florida recently held that a wholly unsecured second mortgage lien may be “stripped off,” even if the property encumbered by the lien is no longer part of the bankruptcy estate due to abandonment by the bankruptcy trustee. The Bankruptcy Court did not specifically reference the consolidated cases now before the U.S. Supreme Court in Bank of Amer. v. Toledo-Cardona, and Bank of Amer. v. Caulkett, which should resolve the issue of whether a wholly unsecured lien may be stripped off in a Chapter 7 bankruptcy. However, the Court noted that, “[a]t…

Posts published in “Mortgage Banking Foreclosure Law”

Mortgage Banking Foreclosure Law

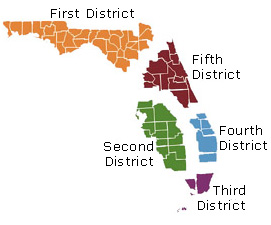

The Florida First District Court of Appeal recently affirmed a trial court’s dismissal of a follow up foreclosure action based on res judicata to the extent the default date was the same as that in the first action, which had been dismissed for failure to prosecute. However, the Court reversed the trial court’s dismissal of the foreclosure action with prejudice and cancellation of the note and mortgage as a sanction because the trial court failed to make the requisite findings of fact. In addition, the Court held that Florida law allows a subsequent foreclosure action based on subsequent and different…

The Florida Third District Court of Appeal recently reversed a trial judge’s refusal to admit a loan payment history into evidence, holding that the foreclosing mortgagee properly demonstrated that the payment history was a business record, even though its witness started working for the mortgagee in 2012 and the payment history included information since 2005. A copy of the opinion is available at: http://www.3dca.flcourts.org/Opinions/3D13-0910.pdf The mortgagee started servicing the loan in 2005. The borrowers defaulted in 2009 and the mortgagee sued to foreclose. At trial, the mortgagee called a “mortgage resolution associate,” who had worked at the mortgagee only since 2012, who…

The Florida First District Court of Appeal recently affirmed a monetary judgment against a borrower in a follow up action to collect the balance owed on a note secured by a mortgage. The follow up action was consolidated with a prior foreclosure action in which the court reserved jurisdiction to enter a deficiency judgment. A copy of the opinion is available at: https://edca.1dca.org/DCADocs/2014/0930/140930_DC05_05012015_101049_i.pdf. The plaintiff bank sued to foreclose its mortgage on the borrower’s property in 2008. The complaint also requested a deficiency judgment. The trial court entered summary judgment against the borrower, reserving jurisdiction to enter a deficiency judgment. The plaintiff mortgagee was…

The Supreme Court of Ohio recently held that, although the plaintiff in a mortgage foreclosure action must have standing to sue when suit is filed, standing can be proven after the case is filed. A copy of the opinion is available at: http://www.supremecourt.ohio.gov/rod/docs/pdf/0/2015/2015-Ohio-1484.pdf The plaintiff mortgagee sued to foreclose its mortgage in 2010 after borrowers defaulted on the promissory note. The complaint did not seek a deficiency because the borrowers’ personal liability had been discharged in bankruptcy. One of the borrowers filed an answer raising lack of standing as a defense. The mortgagee moved for summary judgment, supporting its position on…

The District Court of Appeal of Florida for the Fifth District recently held that a trial court’s refusal to extend the duration of a lis pendens on real property was a departure from the essential requirements of law. A copy of the opinion is available at: http://www.5dca.org/Opinions/Opin2015/042715/5D14-4009.op.pdf Due to a scrivener’s error by the closing agent, the real property that was supposed to have secured a loan was not encumbered by the mortgage. The lender sued to reform the loan documents and foreclose or, in the alternative, to impose an equitable lien against the subject property. The lender moved to extend…

The U.S. Court of Appeals for the First Circuit recently dismissed a borrower’s appeal as moot because the borrower and loan servicer entered into a loan modification agreement while the appeal was pending, meaning the borrower was no longer subject to any actual or threatened foreclosure proceedings. A copy of the opinion is available at: Link to Opinion In 2005, the borrower obtained a $200,000 loan secured by a mortgage on her home. The mortgage was assigned twice, the last one to a bank as trustee. The first assignee, to whom the note was transferred along with the mortgage, endorsed…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure, holding that the mortgagee failed to properly establish the amount of its damages. However, the Appellate Court further held that because the borrower failed to move for dismissal at the close of evidence, the proper remedy was reversal and remand, rather than involuntary dismissal. A copy of the opinion is available at: Link to Opinion A mortgagee filed a foreclosure action against the borrowers in early 2009. Ultimately, the case was tried in November of 2013. It was undisputed at trial that the mortgagee had standing as the…

The Consumer Financial Protection Bureau has ordered RealtySouth, the largest real estate firm in Alabama, to pay a civil monetary penalty of $500,000 for mortgage disclosure violations. The CFPB has charged the company with illegally steering purchasers to use its affiliated company, TitleSouth LLC, for title and closing services. The penalty, along with other injunctive relief, are contained in a consent order under which RealtySouth neither admits nor denies the CFPB’s allegations. The CFPB says the company violated the Real Estate Settlement Procedures Act, when it encouraged its agents and in some cases required them to use TitleSouth in real estate…