A prominent property services company recently reached a $1 million settlement with the Illinois Attorney General, resolving allegations that the property services company supposedly wrongfully “locked Illinois residents out of their homes before a foreclosure was finalized,” and requiring the company to submit to 40 new operating standards with monitoring as to compliance. A copy of the Illinois Attorney General’s press release is available here. The Illinois Attorney General stated that the company was “hired by mortgage lenders to determine whether homeowners in default or facing foreclosure are living in their homes. If a property is deemed vacant, [the company]…

Posts published in “Mortgage Banking Foreclosure Law”

Mortgage Banking Foreclosure Law

The Illinois Appellate Court, First District, recently affirmed the dismissal of a borrower’s petition seeking to vacate a default judgment and order approving sale entered in a mortgage foreclosure action, holding that the borrower waived proper service of the foreclosure complaint. A copy of the opinion is available at: Link to Opinion. The mortgagee sued to foreclose its mortgage under the Illinois Mortgage Foreclosure Law in November 2011. The borrower was served by substitute service shortly thereafter and, approximately five months thereafter, the mortgagee moved for entry of a default. The borrower appeared at the hearing on the mortgagee’s motion for default,…

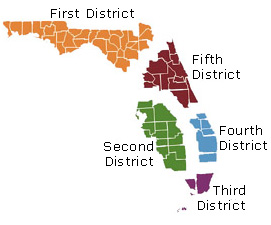

The Florida Fifth District Court of Appeal recently affirmed summary judgment in favor of a mortgagee in an action challenging a notice of default in a mortgage foreclosure action that provided only 28 days to cure instead of the 30 days required under the mortgage. A copy of the opinion is available at: Link to Opinion. The mortgagee sent a notice of default to the borrowers that provided 28 days to cure instead of the 30 days specified in the mortgage. The borrower failed to cure the default and the mortgagee sued to foreclose. Almost four years after the foreclosure action was…

The U.S. Court of Appeals for the Third Circuit recently reversed the dismissal of a borrower’s claims under the Federal Fair Debt Collection Practices Act against a foreclosure law firm, holding that not-yet-incurred fees pled in foreclosure complaint — without conveying that the fees were estimates or imprecise amounts — could constitute an actionable misrepresentation. The Court also rejected the foreclosure firm’s arguments that a foreclosure complaint could not serve as the basis of an FDCPA claim. However, the Court upheld the dismissal of the borrower’s state law claims, due to lack of ascertainable damages. A copy of the opinion is…

In response to a letter from numerous Senators, and in response to “considerable input” from other members of Congress and various trade groups, the Consumer Financial Protection Bureau today announced that it will employ leniency in relation to implementation of the TILA-RESPA Integrated Disclosure Rule. The CFPB’s letter states that the CFPB “will be sensitive to the progress made by those entities that have squarely focused on making good-faith efforts to come into compliance with the Rule on time,” and that the approach “is consistent with the approach we took to implementation of the Title XN mortgage rules in the early months…

The U.S. Supreme Court recently held that a debtor in a Chapter 7 case cannot “strip-off” or void a wholly unsecured junior mortgage under section 506(d) of the Bankruptcy Code. A copy of the opinion is available at: Link to Opinion. The debtors in the consolidated cases both had two mortgages on their homes. The petitioner held a second-position mortgage on each of the homes. The senior mortgage on each home exceeded its fair market value, meaning that the junior mortgages were entirely unsecured and “underwater.” Each debtor moved to “strip-off” or void the junior mortgage liens pursuant to section 506(d)…

The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing. In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own. A copy of the opinion is available at: Link to Opinion The borrowers obtained their mortgage loan in 2006. Attached…

The Florida Fifth District Court of Appeal recently reversed a final judgment of foreclosure in favor of a mortgagee, holding that the mortgagee failed to prove it had standing to sue. In so ruling, the Fifth DCA also held that failure to provide at least 30 days to cure the default in the mortgagee’s notice of default and right to cure did not prejudice the borrower, and therefore did not constitute a valid defense to the foreclosure. A copy of the opinion is available at: Link to Opinion. A corporate borrower and its principal signed a promissory note and mortgage securing…

The Florida Third District Court of Appeal recently reversed a trial court’s order dismissing a mortgage foreclosure action with prejudice and cancelling the note and mortgage as a sanction, focusing on the mortgagee’s failure to amend the complaint and withdraw two affidavits filed in support of the allegedly “lost” note claim when it had later found the original note. A copy of the opinion is available here. The plaintiff mortgagee sued to foreclose its mortgage in May 2009 after the borrower defaulted. The complaint contained a claim to re-establish the lost note. However, more than two years after the case was…

The Florida Fourth District Court of Appeal recently held that the priority between two assignees of notes secured by the same mortgage due to fraud is determined by Article 9 of the Uniform Commercial Code and not the recording statute applicable to assignments of mortgage. The Court held that the transferee that first perfected its interest in a note and related mortgage is entitled to the priority of its interest. A copy of the opinion is available at: http://www.4dca.org/opinions/May%202015/05-06-15/4D13-3193.op.pdf. In April 2006, a borrower obtained a loan and signed a mortgage securing the loan. At closing, the borrower signed two almost identical notes for…

The New York Court of Appeals, the state’s highest court, recently held that the statute of limitations does not bar an action to cancel a mortgage based upon a forged deed. A copy of the opinion is available here. The plaintiff was the administrator of her deceased father’s estate. The decedent and his sister (the “aunt”) inherited from their mother a house in Brooklyn as tenants-in-common. Several years later, in May 2000, the aunt executed a quitclaim deed conveying her one-half interest in the property to her daughter (the “cousin”). In February 2001, the cousin recorded a corrective deed that purported to…

The Supreme Court of Florida recently held that first-party insurer bad faith is not a ‘willful tort,’ and that, as a government entity that enjoys broad statutory immunity from suit, Citizens Property Insurance Corporation (“Citizens”) is consequentially immune from statutory first-party bad faith causes of action. In sum, the Supreme Court determined that the Florida Legislature, when it created Citizens as a property ‘insurer of last resort,’ did not expressly waive Citizens’ statutory immunity from first-party lawsuits arising under Fla. Stat. § 624.155(1), more commonly known as statutory bad faith actions. Florida does not and has never recognized a common…