The U.S. District Court for the Middle District of Florida recently confirmed that Florida’s statute of limitations did not bar a mortgagee from filing a new foreclosure action based on non-payment or other kinds of defaults within the past five years, even where the prior foreclosure action was dismissed without prejudice and acceleration of the mortgage occurred more than five years prior to the second foreclosure action. In so ruling, the Court dismissed an amended complaint for declaratory judgment seeking to invalidate a mortgage. A copy of the opinion is available at: Link to Opinion. A property owner sought a…

Posts published in “Foreclosure”

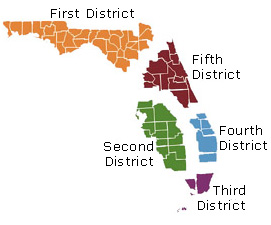

The Second District Court of Appeal of the State of Florida recently affirmed an award of attorney’s fees and costs to two borrowers, even though the borrowers moved for fees and costs more than 30 days after the mortgagee filed a notice of voluntary dismissal that was expressly made conditional upon the parties “agreeing to pay their own attorneys’ fees and costs.” In so ruling, the Appellate Court confirmed that a conditional notice of voluntarily dismissal was ineffective to commence the 30-day period within which to move for attorney’s fees and costs under Florida law. A copy of the opinion…

The Illinois Appellate Court, First District, recently reversed a trial court’s ruling that lack of standing in a mortgage foreclosure case was not an affirmative defense. The Court further remanded the case to allow the borrowers to take discovery, which the Court held was improperly denied by the trial judge. A copy of the opinion is available at: Link to Opinion. A mortgagee filed a foreclosure action, alleging that the borrowers failed to make payments when due. In response, the borrowers filed an answer, which included affirmative defenses of alleged lack of standing and alleged lack of capacity to sue.…

The Appellate Division of the Circuit Court of the 15th Judicial Circuit in Palm Beach County, Fla. recently held that a first mortgagee who took title by foreclosure was not liable for homeowner’s association assessments coming due before it acquired title because the association’s declaration of restrictive covenants absolved a first mortgagee from liability for assessments coming due before it acquires title. A copy of the opinion is available at: Link to Opinion. An individual purchased real property in a subdivision that was subject to a recorded declaration of covenants, restrictions, conditions and easements. The homeowner defaulted on her mortgage…

The District Court of Appeal of Florida, First District, recently denied a property owner’s effort to appeal the trial court’s order limiting the property owner’s extensive discovery requests to a mortgagee relating to standing and satisfaction of mortgage. In so ruling, the Appellate Court concluded that the trial court’s order limiting discovery did not effectively eviscerate the property owner’s affirmative defenses. A copy of the opinion is available at: Link to Opinion. A property owner propounded broad discovery requests related to the defenses that the mortgagee lacked standing to foreclose; and that all mortgages on the property had been satisfied…

The U.S. Bankruptcy Court for the Middle District of Florida recently held that, at a minimum, “surrender” under Bankruptcy Code §§ 521 and 1325 means a debtor cannot take an overt act that impedes a secured creditor from foreclosing its interest in secured property. In so holding, the Court found that actively contesting a post-bankruptcy foreclosure case is inconsistent with a “surrender” of the property. A copy of the opinion is available at: Link to Opinion. The Court addressed two separate bankruptcy cases. The first was a Chapter 7 bankruptcy case, in which the mortgagee instituted a foreclosure action five…

The Illinois Appellate Court, First District, recently affirmed dismissal of the last of several post-judgment challenges to a default foreclosure judgment, holding that the borrower failed to present a sufficient record on appeal, failed to present sufficient evidence to vacate the default judgment, and also waived any objection to the jurisdiction of the trial court. A copy of the opinion is available here: Link to Opinion. In November 2011, a bank filed a complaint for foreclosure against the borrower for defaulting on his mortgage. The borrower was served in December 2011, but never answered. The bank filed a motion for…

The U.S. District Court for the District of New Jersey recently held that New Jersey’s 20-year statute of limitations for residential foreclosures applied to a re-filed foreclosure action, reversing a bankruptcy court’s ruling that the shorter six-year statute of limitations period applied. A copy of the opinion is available at: Link to Opinion. The borrower obtained a $520,000 mortgage loan in February 2007. The Mortgage and Note listed March 1, 2037 as the maturity date. The borrower defaulted in July 2007, and a foreclosure action was filed. However, the foreclosure action was later dismissed for want of prosecution, and then…

The Illinois Appellate Court, First District, recently held that a failure to file a motion to substitute plaintiff in a pending foreclosure proceeding prior to the judicial sale did not invalidate the sale. Also, considering the absence of any meaningful argument advanced on appeal, the Court further ordered counsel for defendant to show cause why he should not be sanctioned. A copy of the opinion is available at: Link to Opinion. The mortgagee filed a foreclosure action, and a judgment of foreclosure was ultimately entered. Thereafter, the mortgagee transferred servicing to a new mortgagee. The new mortgagee appeared at the…

The Illinois Appellate Court, Third District, recently affirmed a grant of summary judgment to a mortgagee over the borrowers’ standing and hearsay challenges. In so ruling, the Appellate Court held that: (1) the mortgagee’s failure to attach a copy of the note with the indorsement in blank to the complaint did not deprive it of standing; and (2) an affidavit by an employee of the current holder of the debt was admissible in a foreclosure proceeding even though some of the business records were created by a prior entity. A copy of the opinion is available at: Link to Opinion.…

The District Court of Appeal of Florida, Fifth District, recently reversed the denial of a motion for deficiency judgment in a foreclosure action, holding that the trial court erroneously required the mortgagee to introduce into evidence the final judgment of foreclosure previously entered in the same case to demonstrate the amount of debt owed. A copy of the opinion is available at: Link to Opinion. The trial court granted summary judgment of foreclosure in favor of the mortgagee, specifically reserving jurisdiction to enter further orders, including deficiency judgments. The borrower did not appeal the judgment of foreclosure. The mortgagee then…

The District Court of Appeal of the State of Florida for the First District recently held that the statute of limitations does not bar a second mortgage foreclosure action based on a subsequent default, regardless of whether the first case was dismissed with or without prejudice. A copy of the opinion is available at: Link to Opinion. The borrowers defaulted on their mortgage in February of 2007. In April of 2007, the plaintiff mortgagee’s predecessor in interest accelerated the note based on the February, 2007 breach and sued to foreclose the mortgage. The case was dismissed without prejudice in October…