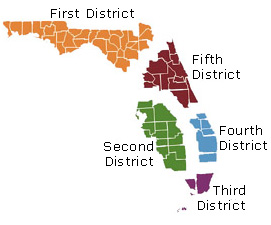

The District Court of Appeal of the State of Florida for the First District recently held that the statute of limitations does not bar a second mortgage foreclosure action based on a subsequent default, regardless of whether the first case was dismissed with or without prejudice. A copy of the opinion is available at: Link to Opinion. The borrowers defaulted on their mortgage in February of 2007. In April of 2007, the plaintiff mortgagee’s predecessor in interest accelerated the note based on the February, 2007 breach and sued to foreclose the mortgage. The case was dismissed without prejudice in October…

Posts published in “Foreclosure”

The Florida Third District Court of Appeal recently reversed a judgment foreclosing a reverse mortgage, holding that the surviving spouse was a “borrower” under the terms of the mortgage, and thus the lender could not meet the condition precedent of her death in order to foreclose. A copy of the opinion is available at: Link to Opinion. In 2008, husband and wife signed a promissory note secured by a “home equity conversion mortgage,” commonly known as a “reverse mortgage.” The wife signed the mortgage, but not the promissory note. After the husband died in 2009, the lender sued to foreclose,…

The New York Court of Appeals recently affirmed a trial court’s denial of a motion for deficiency judgment because the lender presented conclusory, insufficient evidence about the value of the property. In so ruling, the Court held that, even with uncontested deficiency motions, a lender that has foreclosed must present satisfactory evidence about the value of the property. However, the Court also held that when the lender presents insufficient evidence, the trial court should give the lender at least one additional chance to present adequate evidence. A copy of the opinion is available at: Link to Opinion. The lender filed…

The Florida Second District Court of Appeal recently reversed a trial court’s order in a mortgage foreclosure action limiting the liability of a loan servicer who acquired title by foreclosure for past-due condominium assessments, holding that the trial court lacked subject matter jurisdiction because the specific issue of assessments was not litigated or adjudicated by the trial court. A copy of the opinion is available at: Link to Opinion. The owner of a condominium unit failed to pay his mortgage loan, resulting in the loan servicer suing to foreclose the mortgage and obtaining title at the foreclosure sale as the…

The Florida Third District Court of Appeal recently granted rehearing en banc in Deutsche Bank Trust Company Americas v. Beauvais, a case holding that a Florida five-year statute of limitations would bar the re-filed foreclosure action at issue. In so ruling, the Court posed two factual questions to the parties, and requested amicus curiae briefs from the Mortgage Bankers Association of South Florida, the Business Law Section of the Florida Bar, the Real Property Probate & Trust Law Section of the Florida Bar, the Florida Alliance for Consumer Protection, Fannie Mae, and Freddie Mac. A copy of the ruling is…

The U.S. Court of Appeals for the Eleventh Circuit recently affirmed a grant of summary judgment to a servicer and its counsel related to a Georgia non-judicial foreclosure. In so ruling, the Court held that the borrowers had no standing to challenge supposed defects in the assignment of a security deed, and could not sustain a claim for wrongful foreclosure absent evidence that the supposed wrongful conduct actually caused the borrowers’ injuries. A copy of the opinion is available at: Link to Opinion. The case arose out of the servicer’s foreclosure of the borrowers’ residence. Based on this foreclosure, the…

The Florida Fifth District Court of Appeal recently quashed a trial court’s order that a mortgagee’s liability for past due HOA assessments was limited to the lesser of the 12 months of assessments prior to the mortgagee’s acquisition of title in connection with foreclosure, or 1 percent of the original mortgage debt, under the safe-harbor provisions of Fla. Stat. s. 718.116. The Appellate Court held that, although the trial court had correctly interpreted the statute, it lacked jurisdiction to rule on the issue because it failed to specifically reserve jurisdiction to adjudicate the amounts due for HOA assessments in its…

The Florida Second District Court of Appeal recently affirmed a trial court’s order granting a new trial on the issue of damages in a mortgage foreclosure action, holding that a payment history authenticated by the successor loan servicer was admissible under the business records exception to the hearsay rule because the successor servicer independently verified the accuracy of the payment history received from the prior servicer and explained the procedures used to verify the prior servicer’s loan records. A copy of the opinion is available at: Link to Opinion. This was the second appeal in the same foreclosure action. In…

The Appellate Court of Illinois, Third District, recently affirmed a grant of summary judgment of foreclosure in favor of a mortgagee in spite of an inconsistency between the copy of the note attached to the complaint and the note introduced into evidence. A copy of the opinion is available at: Link to Opinion. The foreclosing plaintiff mortgagee originally attached to its complaint a note that had a stamp stating it was a “true and correct copy of the original.” This copy of the note did not have any indorsement. However, at summary judgment, the plaintiff introduced the original note. Unlike…

The New York Court of Appeals recently confirmed that, under New York state law, a loan servicer had standing to foreclose on delinquent borrowers based only upon the servicer’s demonstrated possession of the note evidencing the borrowers’ loan since the time the foreclosure action was filed. The Court also held that, although the loan servicer’s affidavit set out sufficient facts to show exclusive possession and control of the note prior to the date the foreclosure action was filed, the affidavit would have been better and clearer if it had also included facts describing how the servicer came into possession of…

The Illinois Appellate Court, First District, recently affirmed a trial court’s final order in a foreclosure, refusing to vacate summary judgment in favor of the mortgagee, even though the notice of the relevant motions was mailed directly to the borrowers and not their attorney of record, and was originally missing the time of the hearing and the date it was mailed, and even though the borrowers argued that the trial court used the wrong interest rate to calculate the amounts due at sale. In so ruling, the Appellate Court held that the Illinois statutory rate of 9% interest is to…

A prominent property services company recently reached a $1 million settlement with the Illinois Attorney General, resolving allegations that the property services company supposedly wrongfully “locked Illinois residents out of their homes before a foreclosure was finalized,” and requiring the company to submit to 40 new operating standards with monitoring as to compliance. A copy of the Illinois Attorney General’s press release is available here. The Illinois Attorney General stated that the company was “hired by mortgage lenders to determine whether homeowners in default or facing foreclosure are living in their homes. If a property is deemed vacant, [the company]…