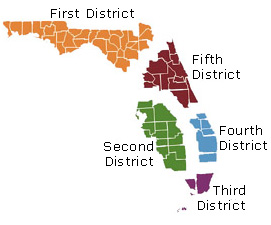

The Third District Court of Appeal, State of Florida, recently reversed a trial court’s dismissal of foreclosure proceedings due to a ruling that a lost note was not properly re-established, holding that the trial court should have entered judgment for the plaintiff mortgagee because the plaintiff mortgagee met the statutory requirements for re-establishing the lost note, and because the trial court admitted business records without objection into evidence showing the note was in default. A copy of the opinion in Nationstar Mortgage, LLC v. Marquez, et al. is available at: Link to Opinion. The borrower signed a note and mortgage in…

Posts tagged as “Mortgage Law”

The District Court of Appeal of the State of Florida, Fourth District, recently reversed a final judgment in favor of a borrower based on an alleged oral modification of the mortgage and the doctrine of promissory estoppel, holding that because the mortgage fell within the statute of frauds, it could not be orally modified, and that the trial court misapplied the doctrine of promissory estoppel. A copy of the opinion in Ocwen Loan Servicing, LLC v. Jean Marie Delvar a/k/a Jean Delvar, et al. is available at: Link to Opinion. A mortgagee sued to foreclose in April 2008. The borrower’s answer raised…

The U.S. Bankruptcy Court for the Middle District of Florida recently overruled a debtor’s objection to a mortgagee’s secured claim and denied the debtor’s motion to determine secured status, holding that the issues should have been brought by adversary proceeding, and in any event neither Florida’s statute of limitations nor its statute of repose barred enforcement of the note and mortgage. A copy of the opinion in In re Anthony is available at: Link to Opinion. A mortgagee filed a mortgage foreclosure action in Florida state court in 2009. The complaint contained a paragraph accelerating the note. The mortgagee also…

Florida’s Third District Court of Appeal recently reversed a trial court’s mortgage foreclosure judgment against non-signatory co-owners, holding that ratification did not apply where the non-signatory owners received no benefit from the loan proceeds and did not authorize an attorney-in-fact to sign the mortgage on their behalf. In so ruling, the Appellate Court rejected the mortgagee’s efforts to impose an equitable lien on the collateral property. A copy of the opinion in Wells Fargo Bank, N.A. v. Clavero, et al. is available at: Link to Opinion. In October 2005, a mother and father, who had purchased their home more than 30 years…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure where a substituted plaintiff failed to prove the original plaintiff had standing when suit was filed. In so ruling, the Appellate Court confirmed that it is not enough for a plaintiff to prove standing when the case is tried, it must also prove standing when the complaint was filed. A copy of the opinion is available at: Link to Opinion. A mortgagee initiated a residential foreclosure action after borrowers defaulted, and the borrowers responded that the mortgagee lacked standing. An assignee was then substituted…

The U.S. District Court for the Middle District of Florida recently confirmed that Florida’s statute of limitations did not bar a mortgagee from filing a new foreclosure action based on non-payment or other kinds of defaults within the past five years, even where the prior foreclosure action was dismissed without prejudice and acceleration of the mortgage occurred more than five years prior to the second foreclosure action. In so ruling, the Court dismissed an amended complaint for declaratory judgment seeking to invalidate a mortgage. A copy of the opinion is available at: Link to Opinion. A property owner sought a…

The District Court of Appeal of Florida, First District, recently denied a property owner’s effort to appeal the trial court’s order limiting the property owner’s extensive discovery requests to a mortgagee relating to standing and satisfaction of mortgage. In so ruling, the Appellate Court concluded that the trial court’s order limiting discovery did not effectively eviscerate the property owner’s affirmative defenses. A copy of the opinion is available at: Link to Opinion. A property owner propounded broad discovery requests related to the defenses that the mortgagee lacked standing to foreclose; and that all mortgages on the property had been satisfied…

The Third District Court of Appeal of the State of Florida recently affirmed the entry of summary judgment in favor of a mortgagee and against the purchaser at a condominium association assessment foreclosure sale based on the after-acquired title doctrine. A copy of the opinion is available at: Link to Opinion. In July 2007, the borrowers obtained a mortgage loan secured by a condominium unit at a luxury building in Miami Beach. Although the mortgage contained the usual covenant that the borrowers owned legal title to and had the right to mortgage the property, the property was in fact owned…

The District Court of Appeal of Florida, Fifth District, recently reversed the denial of a motion for deficiency judgment in a foreclosure action, holding that the trial court erroneously required the mortgagee to introduce into evidence the final judgment of foreclosure previously entered in the same case to demonstrate the amount of debt owed. A copy of the opinion is available at: Link to Opinion. The trial court granted summary judgment of foreclosure in favor of the mortgagee, specifically reserving jurisdiction to enter further orders, including deficiency judgments. The borrower did not appeal the judgment of foreclosure. The mortgagee then…

The District Court of Appeal of the State of Florida for the First District recently held that the statute of limitations does not bar a second mortgage foreclosure action based on a subsequent default, regardless of whether the first case was dismissed with or without prejudice. A copy of the opinion is available at: Link to Opinion. The borrowers defaulted on their mortgage in February of 2007. In April of 2007, the plaintiff mortgagee’s predecessor in interest accelerated the note based on the February, 2007 breach and sued to foreclose the mortgage. The case was dismissed without prejudice in October…

The U.S. Court of Appeals for the Ninth Circuit recently held that the district court abused its discretion in denying a plaintiff’s motion to certify a class of home buyers alleging that a scheme involving a title insurer buying minority interests in title agencies in exchange for referral of future title insurance business violated the federal Real Estate Settlement Procedures Act (RESPA), affirming in part, vacating in part and remanding for further proceedings. In so ruling, the Court held that the Consumer Financial Protection Bureau’s position in its amicus brief was not entitled to Chevron deference, because the CFPB was…

The Florida Second District Court of Appeal recently reversed a trial court’s order in a mortgage foreclosure action limiting the liability of a loan servicer who acquired title by foreclosure for past-due condominium assessments, holding that the trial court lacked subject matter jurisdiction because the specific issue of assessments was not litigated or adjudicated by the trial court. A copy of the opinion is available at: Link to Opinion. The owner of a condominium unit failed to pay his mortgage loan, resulting in the loan servicer suing to foreclose the mortgage and obtaining title at the foreclosure sale as the…