The Supreme Court of Florida recently denied a pro se borrower’s petition to invoke the jurisdiction of the Court, and imposed sanctions against him for filing numerous meritless and inappropriate petitions for relief pertaining to trial court foreclosure proceedings to which he is a defendant. In so doing, the Supreme Court barred the borrower from filing any future pleadings, motions or requests for relief in the Supreme Court related to his foreclosure proceedings, unless filed in good faith by an attorney in good standing. A copy of the opinion in Rivas v. Bank of New York Mellon is available at: Link…

Posts published by “Maurice Wutscher LLP”

The attorneys of Maurice Wutscher are seasoned business lawyers with substantial experience in business law, financial services litigation and regulatory compliance. They represent consumer and commercial financial services companies, including depository and non-depository mortgage lenders and servicers, as well as mortgage loan investors, financial asset buyers and sellers, loss mitigation companies, third-party debt collectors, and other financial services providers. They have defended scores of putative class actions, have substantial experience in federal appellate court litigation and bring substantial trial and complex bankruptcy experience. They are leaders and influencers in their highly specialized area of law. They serve in leadership positions in industry associations and regularly publish and speak before national audiences.

The U.S. Court of Appeals for the Eighth Circuit held that, under the federal Real Estate Settlement Procedures Act, because the borrower did not prove actual damages he also could not prove he was entitled to ‘additional’ statutory damages, and therefore failed to prove an essential element of his RESPA claim. In so ruling, the Eighth Circuit also held that “[a] borrower cannot manufacture a pattern or practice by sending multiple requests in quick succession involving the same subject matter,” and “that two instances of noncompliance are not enough.” Accordingly, the ruling of the trial court granting summary judgment in…

In an important decision for the debt buying industry, the Massachusetts Supreme Judicial Court held that passive debt buyers are not “debt collectors” under the Massachusetts Fair Debt Collection Practices Act (MDCPA). A copy of the decision in Dorrian v. LVNV Funding, LLC is available at: Link to Opinion. An amicus brief filed by Receivables Management Association International and written by Maurice Wutscher attorneys in support of the appellant is available at: Link to Amicus Brief. In Massachusetts, “debt collectors” must obtain a license from the Division of Banks, the state agency tasked with regulating debt collection in the Commonwealth. Under the MDCPA,…

In a data breach putative class action, the U.S. Court of Appeals for the Ninth Circuit recently held that the plaintiffs sufficiently alleged Article III standing based on an alleged “increased risk of future identity theft.” In so ruling, the Ninth Circuit rejected the defendant’s argument that Clapper v. Amnesty International USA, 568 U.S. 398 (2013), in which the Supreme Court of the United States held “an objectively reasonable likelihood” of injury was insufficient to confer standing, required dismissal. A copy of the opinion in In re Zappos.com is available at: Link to Opinion. In January 2012, hackers breached the servers of…

Joining with the Fourth and Ninth Circuits, the U.S. Court of Appeals for the Seventh Circuit recently affirmed a trial court’s summary judgment order in favor of a debt collector and against a debtor finding that the debt collector did not violate the federal Fair Debt Collection Practices Act (FDCPA) by only verifying the information in its records instead of contacting the creditor to verify the debt. In so ruling, the Court also held that the debt collector did not violate the federal Fair Credit Reporting Act (FCRA) because it conducted a reasonable investigation into the disputed information. A copy…

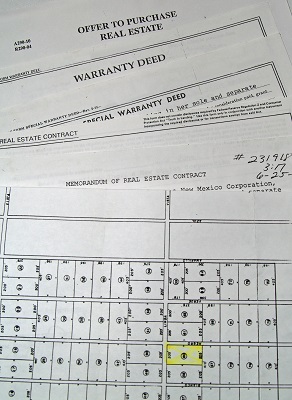

The U.S. Court of Appeals for the Fourth Circuit recently held that a completely unsecured lien may be stripped off in a Chapter 13 bankruptcy proceeding under 11 U.S.C. § 1322(b) even though a proof of claim has not been filed. A copy of the opinion in Edwin Burkhart v. Nancy Spencer Grigsby is available at: Link to Opinion. Debtors filed a Chapter 13 bankruptcy petition in 2012. At the time, the debtors’ principal residence was valued at $435,000 and encumbered by four liens. Creditor 1 held the mortgage lien with the highest priority in the amount due of $609,500. Creditor 2’s two…

The U.S. Court of Appeals for the Eighth Circuit held that the plaintiff borrowers did not offer sufficient evidence to defeat the rebuttable presumption created by the signed acknowledgement that they received the required number of copies of the federal Truth in Lending Act (TILA) notice of right to cancel disclosures. In so ruling, the Court noted that the plaintiff borrowers did not claim personal knowledge of the number of copies of the disclosure provided at closing, but instead relied on the so-called “envelope theory,” which the Court held was inadmissible hearsay. Accordingly, the ruling of the trial court granting…

The U.S. Court of Appeals for the Ninth Circuit recently held that the National Bank Act (NBA) did not preempt California’s state escrow interest law, which requires financial institutions to pay at least 2 percent simple interest per annum on escrow account funds. In so ruling, the Court also held that the federal Truth in Lending Act provisions for escrow accounts, at 15 U.S.C. § 1639d, did not apply to loans originated before the 2013 effective date of the provisions. A copy of the opinion in Lusnak v. Bank of America is available at: Link to Opinion. In July 2008, the…

The U.S. District Court for the Southern District of Florida recently denied a borrower’s motion to exclude testimony of an insurer’s expert regarding the reasonableness of lender-placed insurance premiums levied upon the borrower’s mortgage loan. In so doing, the Court rejected the borrower’s argument that the expert testimony failed to address claims that the insurer colluded with its mortgage servicer to inflate insurance premiums, concluding that the borrower’s objection goes to the weight, rather than the admissibility of the testimony, and that testimony concerning the insurer’s compliance with applicable rules, regulations and industry standards would assist the trier in fact.…

The U.S. Court of Appeals for the Sixth Circuit held that a plaintiff asserting only a bare violation of the federal Fair Debt Collection Practices Act (FDCPA) failed to identify a cognizable injury traceable to the defendant’s alleged conduct, and therefore failed to demonstrate Article III standing. In so ruling, the Sixth Circuit reversed the trial court, and dismissed the appeal and underlying case for lack of jurisdiction. A copy of the opinion in Hagy v. Demers & Adams is available at: Link to Opinion. After the borrowers defaulted on their mortgage loan, the loan servicer initiated foreclosure proceedings against them. Subsequently,…

In the action seeking review of the Federal Communications Commission’s 2015 TCPA Order, the U.S. Court of Appeals for the District of Columbia ruled today that: The FCC’s ruling as to the types of calling equipment that fall within the TCPA’s restrictions would “subject ordinary calls from any conventional smartphone to the Act’s coverage, an unreasonably expansive interpretation of the statute.” This portion of the FCC’s 2015 TCPA Order was set aside and vacated. The FCC’s “approach to calls made to a phone number previously assigned to a person who had given consent but since reassigned to another (nonconsenting) person” —…

The U.S. Court of Appeals for the Ninth Circuit recently affirmed the dismissal of a consumer’s putative class action alleging willful violations of the federal Fair Credit Reporting Act (FCRA) for lack of standing under Spokeo, Inc. v. Robins, 136 S. Ct. 1540 (2016). In so ruling, the Court held that merely printing a credit card receipt without redacting the card’s full expiration date did not allege the concrete injury required, where no second receipt existed, the consumer did not lose the receipt, nobody stole the receipt, and nobody stole the consumer’s identity. A copy of the opinion in Bassett…