The U.S. Court of Appeals for the Sixth Circuit held that a plaintiff asserting only a bare violation of the federal Fair Debt Collection Practices Act (FDCPA) failed to identify a cognizable injury traceable to the defendant’s alleged conduct, and therefore failed to demonstrate Article III standing.

In so ruling, the Sixth Circuit reversed the trial court, and dismissed the appeal and underlying case for lack of jurisdiction.

A copy of the opinion in Hagy v. Demers & Adams is available at: Link to Opinion.

After the borrowers defaulted on their mortgage loan, the loan servicer initiated foreclosure proceedings against them.

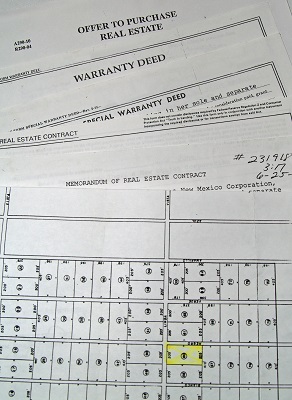

Subsequently, an attorney for the law firm representing the servicer sent a letter to the borrowers on June 8, 2010 containing a Warranty Deed in Lieu of Foreclosure and stating that if the borrowers executed the deed, the servicer “has advised me that it will waive any deficiency balance.” The borrowers executed the deed on June 24, 2010.

On June 30, 2010, the attorney sent a letter to the borrowers’ attorney confirming receipt of the executed deed and reaffirming that the servicer “will not attempt to collect any deficiency balance which may be due and owing after the sale of the collateral.”

Three weeks later, the servicer dismissed the foreclosure complaint. Thereafter, the servicer began calling the borrowers again to collect on debt they no longer owed. The borrowers stated that they did not have to pay anything in light of the deed. The servicer realized it made a mistake and the borrowers owed nothing more.

The borrowers then filed a lawsuit in 2011 against the servicer, an employee of the servicer, the servicer’s law firm and its attorney.

The attorney and law firm moved to dismiss the claims against them. The trial court dismissed the claim based on the June 8 letter because it was time barred but denied dismissal as to the remaining claims.

After discovery, the attorney and the borrowers each moved for summary judgment, and the trial court ruled in favor of the borrowers, reasoning that the attorney’s June 30 letter to the borrowers’ attorney “fail[ed] to disclose” that it was a “communication . . . from a debt collector” in violation of 15 U.S.C. § 1692e(11).

Believing that Ohio law incorporates federal requirements, the trial court also ruled that the attorney violated Ohio statute by failing to make the section 1692e(11) disclosure in the June 8 and June 30 letters and by failing to provide the notice required by section 1692g(a) within five days of the initial communication with the consumer.

The borrowers were awarded $1,800 in statutory damages, $312 in costs, and $74,196 in attorney’s fees.

After claims with the remaining defendants were resolved, the attorney and law firm appealed.

On appeal, the attorney and law firm argued: (1) the trial court lacked jurisdiction because the borrowers did not have standing to assert their claims, (2) the June 30 letter sent to the borrowers’ attorney did not violate the FDCPA because it was not a “communication with a consumer,” (3) they did not violate Ohio law because it does not incorporate the requirements of federal law and the case did not involve a “consumer transaction” or “supplier” as required under Ohio law, and (4) the trial court abused its discretion in awarding disproportionate attorney’s fees.

The Sixth Circuit only addressed the first issue, as it ultimately determined that it lacked jurisdiction because the borrowers did not demonstrate Article III standing.

In analyzing the issue, the Court noted that the “’irreducible constitutional minimum’ for standing requires the [borrowers] to show (1) a particular and concrete injury, (2) caused by [the attorney] and (3) redressable by the courts.” The Sixth Circuit held that the borrowers did not meet this burden.

In so ruling, the Court acknowledged that the borrowers made allegations with respect to each element of the cause of action under the FDCPA: (1) the borrowers received a letter from the attorney about a debt implicating a duty established by the FDCPA, (2) the letter failed to include the required disclosure, and (3) they sought statutory damages.

“These kinds of allegations usually eliminate any doubts about Article III standing and usually allow the parties and the court to move on to the merits. But usually is not always.”

Citing Spokeo, Inc. v. Robins, 136 S. Ct. 1540 (2016), the Sixth Circuit determined that “[w]hat makes this case different is that [the attorney] challenges Congress’s authority to create this injury – to create an injury in fact that involves no harm of any sort that could satisfy the injury-in-fact requirements of Article III.”

Notably, the borrowers admitted that what the attorney said in his letter “turned out to be true.” Moreover, “[f]ar from causing [the borrowers] injury . . . the June 30 letter gave them piece of mind, and they have never testified otherwise,” and “no one plausibly argues (or even alleges) that the [borrowers] suffered any actual injury or damages from the letter.” Instead, the letter “had nothing to do with the true source of [the borrowers’] anxiety,” which was the servicer’s phone calls seeking a deficiency.

Under these facts, the Sixth Circuit determined that the only thing left was “the possibility that Congress’s creation of a statutory injury and damages suffices to satisfy Article III’s standing imperative.”

However, again relying on Spokeo, the Sixth Circuit ruled that the borrowers “must point to some harm other than the fact of ‘a bare procedural violation,’” because “[n]ot all procedural violations, not even all inaccuracies, cause real harm.”

Further citing Spokeo, the Sixth Circuit stated that “[a]lthough Congress may ‘elevate’ harms that ‘exist’ in the real world before Congress recognized them to actionable legal status, it may not simply enact an injury into existence, using its lawmaking power to transform something that is not remotely harmful into something that is.”

Here, the relevant provision of the FDCPA requires debt collectors to disclose in their “communications [with consumers] that the communication is from a debt collector,” and entitles individuals to sue for failure to comply with that requirement. 15 U.S.C. § 1692e(11).

The Court held:

- “Nowhere in the Act (or for that matter the legislative record) does Congress explain why the absence of such a warning always creates an Article III injury.”

- “Because Congress made no effort to show how a letter like this would create a cognizable injury in fact and because we cannot see any way in which that could be the case, we must dismiss this claim for lack of standing.”

- “For the same reason that the [borrowers] lack standing to bring the federal claim, they lack standing to bring the state-law claims, which rely on incorporating the federal law wholesale.”

Accordingly, the Sixth Circuit reversed the trial court’s ruling finding subject matter jurisdiction, vacated its order entering summary judgment for the borrowers, and dismissed the case for lack of jurisdiction.