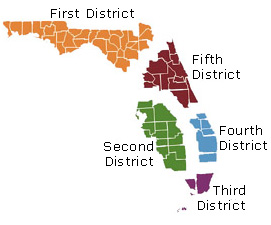

The Third District Court of Appeal, State of Florida, recently reversed a trial court’s dismissal of foreclosure proceedings due to a ruling that a lost note was not properly re-established, holding that the trial court should have entered judgment for the plaintiff mortgagee because the plaintiff mortgagee met the statutory requirements for re-establishing the lost note, and because the trial court admitted business records without objection into evidence showing the note was in default. A copy of the opinion in Nationstar Mortgage, LLC v. Marquez, et al. is available at: Link to Opinion. The borrower signed a note and mortgage in…

Posts tagged as “Florida”

The District Court of Appeal of the State of Florida, Fourth District, recently reversed a final judgment in favor of a borrower based on an alleged oral modification of the mortgage and the doctrine of promissory estoppel, holding that because the mortgage fell within the statute of frauds, it could not be orally modified, and that the trial court misapplied the doctrine of promissory estoppel. A copy of the opinion in Ocwen Loan Servicing, LLC v. Jean Marie Delvar a/k/a Jean Delvar, et al. is available at: Link to Opinion. A mortgagee sued to foreclose in April 2008. The borrower’s answer raised…

The District Court of Appeal of Florida, Second District, recently dismissed the appeal of a foreclosure judgment by a third party purchaser of the collateral property, where the third party purchased the collateral property while it was the subject of a foreclosure proceeding and a recorded lis pendens. In so ruling, the Appellate Court confirmed a third party purchaser had no standing to appeal a final judgment of foreclosure where the purchaser did not appeal a prior denial of its motion to intervene, even though the third party purchaser’s name was erroneously placed in the style of the uniform final…

The District Court of Appeal of the State of Florida, Fifth District, recently held that the trial court erred by denying the borrower’s motion to involuntarily dismiss a foreclosure action, because the plaintiff mortgagee’s counsel failed to properly introduce evidence to reestablish the lost note, prove that it had standing to foreclose, prove the amount owed, and demonstrate compliance with the mortgage’s condition precedent of giving notice of default. A copy of the opinion in Figueroa v. Federal National Mortgage Association, etc., et al is available at: Link to Opinion. A servicer foreclosed alleging that the borrower defaulted under the note by failing…

The District Court of Appeal of the State of Florida, Fourth District, recently held that a lender cannot be held liable for its customer’s suicide because it does not have any special relationship with the customer that gives rise to a duty to prevent the customer’s suicide. A copy of the opinion is available at: Link to Opinion. The personal representative of the estate of a mentally ill decedent sued the decedent’s bank and its senior vice president for wrongful death. The amended complaint alleged that the decedent suffered from a type of severe anxiety that made him unable to…

Florida’s Third District Court of Appeal recently reversed a trial court’s mortgage foreclosure judgment against non-signatory co-owners, holding that ratification did not apply where the non-signatory owners received no benefit from the loan proceeds and did not authorize an attorney-in-fact to sign the mortgage on their behalf. In so ruling, the Appellate Court rejected the mortgagee’s efforts to impose an equitable lien on the collateral property. A copy of the opinion in Wells Fargo Bank, N.A. v. Clavero, et al. is available at: Link to Opinion. In October 2005, a mother and father, who had purchased their home more than 30 years…

The District Court of Appeal of Florida, Second District, recently affirmed the trial court’s denial of a third party record title holder’s motion to cancel a mortgage foreclosure sale, even though the third party movant acquired title in a prior homeowners association lien foreclosure action, and even though the third party movant alleged that the mortgagee thwarted its redemption rights by supposedly failing to provide an estoppel letter. A copy of the opinion in Whitburn, LLC v. Wells Fargo Bank, N.A. is available at: Link to Opinion. In December 2012, a mortgagee filed a foreclosure action along with a lis pendens against…

The U.S. Court of Appeals for the Eleventh Circuit recently struck down Florida’s “anti-surcharge” statute, Fla. Stat. § 501.0117, holding that the Florida law prohibiting charging a fee to pay by credit card was an unconstitutional restriction of free speech. A copy of the opinion in Dana’s Railroad Supply, et al v. Attorney General, State of Florida is available at: Link to Opinion. Four small businesses filed suit after receiving cease-and-desist letters from the Florida Attorney General demanding they refrain from charging lower prices for customers using cash and higher prices for those using credit cards, and demanding that they refrain from…

The District Court of Appeals of the State of Florida, Fourth District, recently reversed final judgment of foreclosure in favor of a mortgagee for entry of judgment in favor of the mortgagors, where the mortgagee failed to prove that it came into possession of the note containing an undated, blank endorsement before the foreclosure was filed. In so ruling, the Fourth District confirmed that a trial court abuses its discretion in admitting business records if it is not established that the records were made at or near the time of the event. In addition, the Fourth District held that a…

The Appellate Division of the Fifteenth Judicial Circuit of the State of Florida recently reversed dismissal of a federal Fair Debt Collection Practices Act (FDCPA) claim alleging a debt collector’s letter falsely represented a bank was the creditor of a loan. In so ruling, the Appellate Division confirmed that even though a foreclosure action is not necessarily debt collection, the enforcement of a promissory note constitutes debt collection activity even if done in conjunction with the enforcement of a security interest, and even the debt collector stated it was seeking solely to foreclose the creditor’s lien on the real estate,…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure where a substituted plaintiff failed to prove the original plaintiff had standing when suit was filed. In so ruling, the Appellate Court confirmed that it is not enough for a plaintiff to prove standing when the case is tried, it must also prove standing when the complaint was filed. A copy of the opinion is available at: Link to Opinion. A mortgagee initiated a residential foreclosure action after borrowers defaulted, and the borrowers responded that the mortgagee lacked standing. An assignee was then substituted…

The Court of Appeal of the State of Florida, Fifth District, recently affirmed the dismissal of a check payee’s claims against the drawee bank for charging a fee to cash the check in person, holding that while section 655.85, Florida Statutes, prohibits the bank from charging such a fee, it does not create a private cause of action. However, the Court also held that federal law did not preempt the state “anti-check cashing fee” statute, even as applied to an out-of-state insured state bank. A copy of the opinion is available at: Link to Opinion. The payee of a check…