The U.S. Court of Appeals for the Second Circuit recently reversed the dismissal of a consumer’s claim alleging that a mortgage loan servicer violated the federal Fair Debt Collection Practices Act by sending a servicing transfer notice that did not contain the disclosures required under the FDCPA, 15 U.S.C. 1692g. A copy of the opinion is available at: Link to Opinion. The borrower argued that the defendant mortgage servicer violated the FDCPA by sending him two written communications: (1) a RESPA transfer of servicing notice, informing the borrower that the mortgage servicer had become the servicer for the borrower’s mortgage…

Posts published in “Mortgage Banking Foreclosure Law”

Mortgage Banking Foreclosure Law

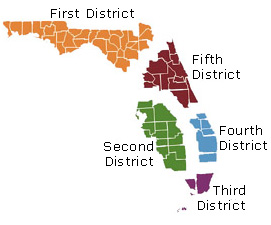

The Florida Second District Court of Appeal recently upheld a mortgagee’s notice of default that substantially complied with the applicable provision of the mortgage, ruling that strict compliance is not required. A copy of the opinion is available at: Link to Opinion. The borrowers obtained a mortgage in May 2007 and defaulted in November 2008. In December 2008, the mortgagee sent the borrowers a letter demanding that they cure the default within 30 days, providing the amount needed to reinstate the loan, and warning that failure to cure would result in acceleration and foreclosure. In February 2009, the mortgagee filed…

The Florida Third District Court of Appeal recently granted rehearing en banc in Deutsche Bank Trust Company Americas v. Beauvais, a case holding that a Florida five-year statute of limitations would bar the re-filed foreclosure action at issue. In so ruling, the Court posed two factual questions to the parties, and requested amicus curiae briefs from the Mortgage Bankers Association of South Florida, the Business Law Section of the Florida Bar, the Real Property Probate & Trust Law Section of the Florida Bar, the Florida Alliance for Consumer Protection, Fannie Mae, and Freddie Mac. A copy of the ruling is…

A large mortgage lender recently prevailed against both the City of Los Angeles and the County of Cook, Illinois, in lawsuits alleging “disparate impact” discrimination in violation of Title VIII of the Civil Rights Act of 1968, 42 U.S.C. § 3601 et seq., more commonly known as the federal Fair Housing Act (FHA). As you may recall, the City of Los Angeles alleged that Wells Fargo & Co. and Wells Fargo Bank, N.A. “engaged in a continuous pattern and practice of mortgage discrimination in Los Angeles since at least 2004 by imposing different terms or conditions on a discriminatory and…

The U.S. Court of Appeals for the Eleventh Circuit recently affirmed a grant of summary judgment to a servicer and its counsel related to a Georgia non-judicial foreclosure. In so ruling, the Court held that the borrowers had no standing to challenge supposed defects in the assignment of a security deed, and could not sustain a claim for wrongful foreclosure absent evidence that the supposed wrongful conduct actually caused the borrowers’ injuries. A copy of the opinion is available at: Link to Opinion. The case arose out of the servicer’s foreclosure of the borrowers’ residence. Based on this foreclosure, the…

The Florida Fifth District Court of Appeal recently quashed a trial court’s order that a mortgagee’s liability for past due HOA assessments was limited to the lesser of the 12 months of assessments prior to the mortgagee’s acquisition of title in connection with foreclosure, or 1 percent of the original mortgage debt, under the safe-harbor provisions of Fla. Stat. s. 718.116. The Appellate Court held that, although the trial court had correctly interpreted the statute, it lacked jurisdiction to rule on the issue because it failed to specifically reserve jurisdiction to adjudicate the amounts due for HOA assessments in its…

The Florida Second District Court of Appeal recently affirmed a trial court’s order granting a new trial on the issue of damages in a mortgage foreclosure action, holding that a payment history authenticated by the successor loan servicer was admissible under the business records exception to the hearsay rule because the successor servicer independently verified the accuracy of the payment history received from the prior servicer and explained the procedures used to verify the prior servicer’s loan records. A copy of the opinion is available at: Link to Opinion. This was the second appeal in the same foreclosure action. In…

The Consumer Financial Protection Bureau has issued its final rule confirming the delay of the effective date of the TILA-RESPA Integrated Disclosures (TRID) rule to Oct. 3, 2015. A copy of the final rule is available at: Link to Final Rule. The final rule also makes certain technical corrections, including: Amending 12 CFR § 1026.38(i)(8)(ii) and (iii)(A) to “include, in the amount disclosed as ‘Final’ for Adjustments and Other Credits, the amount disclosed under § 1026.38(j)(1)(iii) for certain personal property sales, thus conforming the calculation of Adjustments and Other Credits on the Closing Disclosure and Loan Estimate;” and Amending 12 CFR…

The Court of Appeals of New York recently held that a mortgage loan repurchase action for breach of representations and warranties accrued when the representations and warranties were made, and the obligation to cure and repurchase was not a separate and continuing promise of future performance. A copy of the opinion is available at: Link to Opinion. The sponsor of a residential mortgage-backed securities trust purchased 8,815 mortgage loans from third-party originators. This pool of loans was sold to an affiliate, known as a “depositor,” pursuant to a Mortgage Loan Purchase Agreement (MLPA) between the sponsor and the depositor dated…

The U.S. Court of Appeals for the Ninth Circuit recently affirmed a district court’s dismissal of a borrower’s claims for breach of contract and breach of fiduciary duty relating to alleged failures to properly disburse escrow amounts against a non-servicer assignee of a mortgage loan. In so ruling, the Court confirmed that Washington does not bar splitting the loan servicing duties from the right to receive payment under the note. A copy of the opinion is available at: Link to Opinion. The deed of trust between the borrower and the loan originator required the borrower to pay the hazard insurance…

The U.S. District Court for the District of Nevada recently held that the federal Housing Economic Recovery Act of 2008 (HERA) requires super-priority lien holders to obtain consent from the Federal Housing Finance Agency (FHFA) prior to foreclosing on any liens on properties where the FHFA is acting as conservator. A copy of the opinion is available at: Link to Opinion. In 2007, two borrowers obtained a $105,700 loan on a property located in Las Vegas that was secured by a Deed of Trust on the property. The property was also part of a homeowners association (HOA) and subject to…

The Ninth Judicial Circuit Court of Florida recently granted summary judgment to an insured against a title insurer after the title insurer failed to except a title defect from coverage under a policy. In so ruling, the Court held that breaching a policy of title insurance exposes the title company to extra-contractual liability beyond the policy’s limits. A copy of the opinion is available here: Link to Opinion. In this case, the insured had purchased 253 acres of property in Florida. The title insurer issued a policy that failed to note a recorded mobile home plat that appeared to cover…