The Illinois Appellate Court, First District, recently affirmed the dismissal of a borrower’s petition seeking to vacate a default judgment and order approving sale entered in a mortgage foreclosure action, holding that the borrower waived proper service of the foreclosure complaint. A copy of the opinion is available at: Link to Opinion. The mortgagee sued to foreclose its mortgage under the Illinois Mortgage Foreclosure Law in November 2011. The borrower was served by substitute service shortly thereafter and, approximately five months thereafter, the mortgagee moved for entry of a default. The borrower appeared at the hearing on the mortgagee’s motion for default,…

Posts published in “Foreclosure”

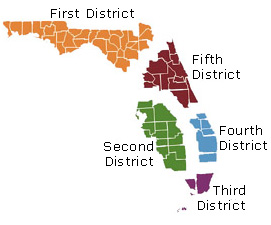

The Florida Fifth District Court of Appeal recently affirmed summary judgment in favor of a mortgagee in an action challenging a notice of default in a mortgage foreclosure action that provided only 28 days to cure instead of the 30 days required under the mortgage. A copy of the opinion is available at: Link to Opinion. The mortgagee sent a notice of default to the borrowers that provided 28 days to cure instead of the 30 days specified in the mortgage. The borrower failed to cure the default and the mortgagee sued to foreclose. Almost four years after the foreclosure action was…

The U.S. Court of Appeals for the Third Circuit recently reversed the dismissal of a borrower’s claims under the Federal Fair Debt Collection Practices Act against a foreclosure law firm, holding that not-yet-incurred fees pled in foreclosure complaint — without conveying that the fees were estimates or imprecise amounts — could constitute an actionable misrepresentation. The Court also rejected the foreclosure firm’s arguments that a foreclosure complaint could not serve as the basis of an FDCPA claim. However, the Court upheld the dismissal of the borrower’s state law claims, due to lack of ascertainable damages. A copy of the opinion is…

The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing. In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own. A copy of the opinion is available at: Link to Opinion The borrowers obtained their mortgage loan in 2006. Attached…

The Florida Fifth District Court of Appeal recently reversed a final judgment of foreclosure in favor of a mortgagee, holding that the mortgagee failed to prove it had standing to sue. In so ruling, the Fifth DCA also held that failure to provide at least 30 days to cure the default in the mortgagee’s notice of default and right to cure did not prejudice the borrower, and therefore did not constitute a valid defense to the foreclosure. A copy of the opinion is available at: Link to Opinion. A corporate borrower and its principal signed a promissory note and mortgage securing…

The Florida Third District Court of Appeal recently reversed a trial court’s order dismissing a mortgage foreclosure action with prejudice and cancelling the note and mortgage as a sanction, focusing on the mortgagee’s failure to amend the complaint and withdraw two affidavits filed in support of the allegedly “lost” note claim when it had later found the original note. A copy of the opinion is available here. The plaintiff mortgagee sued to foreclose its mortgage in May 2009 after the borrower defaulted. The complaint contained a claim to re-establish the lost note. However, more than two years after the case was…

The Florida First District Court of Appeal recently affirmed a trial court’s dismissal of a follow up foreclosure action based on res judicata to the extent the default date was the same as that in the first action, which had been dismissed for failure to prosecute. However, the Court reversed the trial court’s dismissal of the foreclosure action with prejudice and cancellation of the note and mortgage as a sanction because the trial court failed to make the requisite findings of fact. In addition, the Court held that Florida law allows a subsequent foreclosure action based on subsequent and different…

The Supreme Court of Ohio recently held that, although the plaintiff in a mortgage foreclosure action must have standing to sue when suit is filed, standing can be proven after the case is filed. A copy of the opinion is available at: http://www.supremecourt.ohio.gov/rod/docs/pdf/0/2015/2015-Ohio-1484.pdf The plaintiff mortgagee sued to foreclose its mortgage in 2010 after borrowers defaulted on the promissory note. The complaint did not seek a deficiency because the borrowers’ personal liability had been discharged in bankruptcy. One of the borrowers filed an answer raising lack of standing as a defense. The mortgagee moved for summary judgment, supporting its position on…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure, holding that the mortgagee failed to properly establish the amount of its damages. However, the Appellate Court further held that because the borrower failed to move for dismissal at the close of evidence, the proper remedy was reversal and remand, rather than involuntary dismissal. A copy of the opinion is available at: Link to Opinion A mortgagee filed a foreclosure action against the borrowers in early 2009. Ultimately, the case was tried in November of 2013. It was undisputed at trial that the mortgagee had standing as the…