The FCC’s much anticipated TCPA rulings were released this past Friday. On Friday, July 17, our panel of esteemed TCPA attorneys – both plaintiff’s and defense – will give you a first look at how the rulings will drive TCPA litigation, from both the plaintiff’s and defense perspective. I expect to hear some interesting debate. Here are the salient issues we will cover: Dialer Technology What do the rulings say about predictive dialers, preview dialers and future dialing technology? What does the FCC mean what it talks about “capacity” and “calling from a list of numbers?” Can you ever be certain…

Posts published by “Donald Maurice”

Donald Maurice provides counsel to the financial services industry, successfully litigating matters in the state and federal courts in individual and class actions. He has successfully argued before the Third, Fourth and Eighth Circuit U.S. Courts of Appeals, and has represented the financial services industry before several courts including as counsel for amicus curiae before the United States Supreme Court. He counsels clients in regulatory actions before the CFPB, and other federal and state regulators and in the development and testing of debt collection compliance systems. Don is peer-rated AV by Martindale-Hubbell, the worldwide guide to lawyers. In addition to being a frequent speaker and author on consumer financial services law, he serves as outside counsel to RMA International, on the governing Board of Regents of the American College of Consumer Financial Services Lawyers, and on the New York City Bar Association's Consumer Affairs Committee. From 2014 to 2017, he chaired the ABA's Bankruptcy and Debt Collection Subcommittee. For more information, see https://mauricewutscher.com/attorneys/donald-maurice/

Maine has amended its statute regulating debt collection while bills regarding debt collection are pending in other states. Here’s a breakdown of Maine’s amendments: Written or Court Entered Settlement and Payment Agreements Settlement agreements must be in a writing or entered in “open court” or “approved by the court and included in a court order.” For settlement agreements that are not made in open court or in a court order, the debt collector must “provide” a copy of the written settlement agreement to the debtor within 10 days of the agreement being made. A debtor is not required to make…

A bill before the U.S. Senate would make commercial robocalls a federal crime, exacting up to a $20,000 fine and a prison sentence of up to 10 years. Introduced on June 25 by Sen. Chuck Schumer (D-NY), S. 1681 would criminalize the use of an automatic telephone dialing system or an artificial or prerecorded voice for calls made “for the purpose of soliciting or encouraging the purchase or rental of, or investment or enrollment in, property, goods, or services,” unless the caller obtained the “prior express written consent” of the recipient of the call. The proposed QUIET Act is nearly identical to…

Providing statements of the amount due, or of the amount required to cure a default – such as in Notices of Intention to Foreclose, periodic statements, and the like — has become risky for mortgage servicers under a recent ruling from the U.S. Court of Appeals for the Third Circuit. The ruling, Kaymark v. Bank of America, involved a foreclosure complaint, which included projected fees and costs that had not yet been incurred at the time the complaint was filed. Ultimately the costs were incurred, but the court found that the foreclosure complaint’s inclusion of the projected fees and costs in the amounts…

We expect certainty in the law, especially when it comes to a commercial transaction. A valid and enforceable contract should not become unenforceable simply because it was sold. And worse, it should not be unlawful for the buyer to enforce the purchased contract. But that is the decision of the U.S. Court of Appeals for the Second Circuit in Madden v. Midland. The facts are not remarkable. Ms. Madden applied for and received a credit card from Bank of America, a national bank. Bank of America transferred her account to FIA Card Services, also a national bank, who issued her a change…

FCC Chairman Tom Wheeler’s TCPA “Fact Sheet” on forthcoming declaratory rulings issues should scare the heck out of any business using any telephone to reach potential, current or former customers. I believe the rulings will have a substantial impact on customer operations in the financial services industry. I expect the Declaratory Rulings to touch a number of crucial issues driving TCPA litigation. So I’ve assembled a team of seasoned TCPA litigators to talk with you on Monday, June 22 June 29, on how these declaratory rulings will affect the risks of using telephone technology. Here are the hot issues I expect the ruling to…

Collecting statutory prejudgment interest in California did not violate the Fair Debt Collection Practices Act, under a decision earlier this month from the Ninth Circuit Court of Appeals. The decision, Diaz v Kubler, rejected the debtor’s contention that interest allowed by a California statute could not be collected unless a judgment was first entered. Decision Has Limited Impact While the decision brings clarity when collecting prejudgment interest in California, it does not authorize the collection of prejudgment interest under other state statutes. Last year, the Sixth Circuit Court of Appeals found that a debt buyer’s collection of prejudgment interest under…

Statutory damage claims, like those under the TCPA and the FCRA, will be scrutinized in the next session of the U.S. Supreme Court and its decisions could have broad implications for the financial services industry. Today we look at one of the cases the court will consider, Gomez v. Campbell-Ewald Co. The case considers whether an offer of complete relief to a litigant will extinguish both her individual claims and, prior to class certification, render her class claims moot. A decision will likely impact litigation under the FDCPA, TILA, EFTA and other federal laws, which can expose financial services companies to…

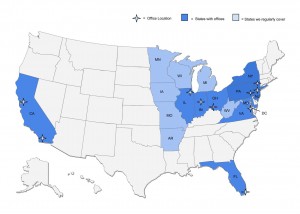

You may have noticed a new firm logo on our site. I’m very happy to announce the merger of Maurice & Needleman with financial services law firm McGinnis Wutscher. The alliance enables us to provide the services of 24 lawyers in 10 offices in the Northeast, Southeast, Midwest and West. We now have offices in Chicago, Cincinnati, Indianapolis, Miami, San Diego, San Francisco and Washington in addition to New York, Flemington and Philadelphia. As Maurice Wutscher, the firm will focus in the areas of consumer credit defensive litigation, commercial banking litigation, regulatory compliance, insurance recovery and advisory services, professional liability defense and ethics matters. The lawyers of…

New York’s Department of Financial Services published regulations on Dec. 3, 2014, which would require debt collectors to make additional disclosures to consumers following initial communications, provide consumers who dispute charged-off debt with certain information, adopt procedures concerning the applicability of statutes of limitations, maintain certain records and provide written confirmation of settlements, among other things. The regulations (available here) are applicable to third-party debt collectors (those who collect debts owed to others) and debt-buyers. On Jan. 15, I’ll be discussing the regulations in a DBA International webinar Working with New York’s Latest Debt Collection Regulations (register here). In the meantime, here is a closer look at the regulations. Who…

It has been several months since the Eleventh Circuit handed down its decision holding that filing a proof of claim on “time-barred” debt violates the FDCPA. The request for rehearing, which I reported about this past summer, was denied. While a petition for certification to the Supreme Court is possible, even if the court accepts the case (and that’s a tall order itself) we would not see a decision before 2016. A Multitude of Crawford-type Claims While it was a safe bet a new round of FDCPA claims would be spawned by Crawford, the sheer number of claims being filed outside the Eleventh Circuit is surprising.…

The Federal Trade Commission has posted seven steps debt brokers should follow to keep data secure on the Bureau of Consumer Protection’s Business Center Blog. This latest guidance comes after the FTC requested that a federal court order two debt brokers that exposed the personal information of more than 70,000 consumers online to notify the consumers and give them direction on how to protect themselves against fraud and identity theft. According to the FTC, two debt brokers violated the FTC Act when they placed the personal information of the consumers, including bank account and credit card numbers, birth dates, employment information and more, on a…