Legislation introduced in the New Jersey Assembly and Senate would prohibit “health care providers” from furnishing information concerning medical debt to credit reporting agencies.

Posts tagged as “Receivables”

The New York Court of Appeals recently reversed the rulings of both the trial court and intermediate appellate court and held that under Article 9 of the Uniform Commercial Code (UCC) a secured lender may collect the accounts receivables owed to the debtor by third parties.

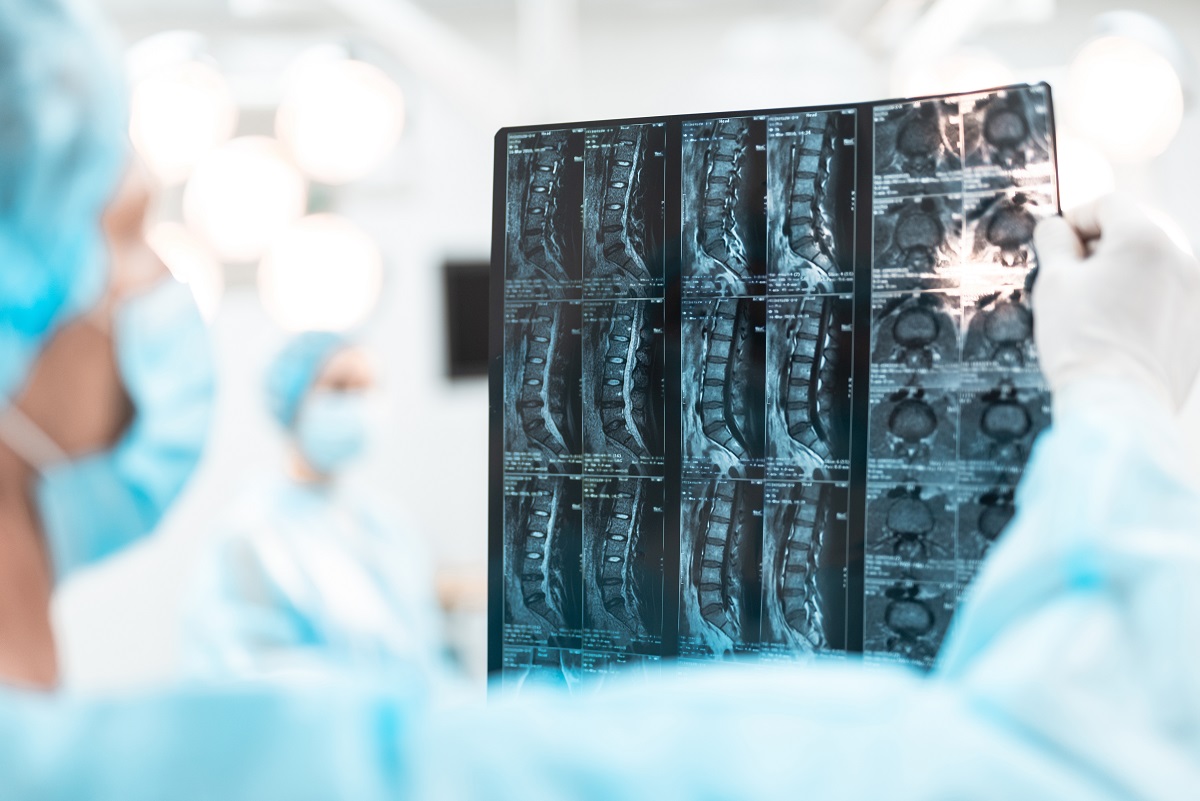

Continuing with the heavy trend 2022 has seen of both federal and state regulator focus on medical debt coming on the heels of the aftermath of the COVID-19 pandemic, a bill introduced in the U.S. Senate is taking aim at the collection of medical debt.

A group is pushing Arizona Proposition 209, a ballot measure they say will reduce the burden of “medical debt.” But while a small portion of Proposition 209 might relieve some of the burden of medical debt, other beneficiaries are swindlers and bad actors.

The U.S. Court of Appeals for the Third Circuit recently confirmed that parties may contractually delegate questions of arbitrability to the arbitrator and reversed a District Court’s order denying a debt buyer's motion to compel arbitration when there was a question about the validity of assignment of the underlying contract.

Medical debt continues to dominate the headlines in 2022 and continues to be an area of significant focus for the Consumer Financial Protection Bureau.

In an update to an article we published earlier this week regarding the three major credit reporting agencies Equifax, Experian and TransUnion issuing a joint statement last week regarding how medical debt will be treated and reported on consumer credit reports, those agencies provided further clarification to data furnishers on March 22.

In just a few weeks several provisions of the New York Consumer Credit Fairness Act (NYCCFA) will take effect.

In a year that is still quite young, medical debt continues to find its way into the headlines of the receivables management industry. Continuing the trend, this past Friday, March 18, saw the three major credit reporting agencies Equifax, Experian and TransUnion issue a joint statement regarding how medical debt will be treated and reported on consumer credit reports.

The U.S. Court of Appeals for the Seventh Circuit recently affirmed a trial court's ruling granting summary judgment in favor of two debt collectors for alleged violations of the federal Fair Debt Collection Practices Act and federal Fair Credit Reporting Act relating to their attempts to collect a debt resulting from identify theft.

Federal courts have recently dismissed a number of cases brought by consumers alleging violations of consumer protection law because they lack “standing.” The trend has been hastened by the U.S. Supreme Court’s decision last year in TransUnion LLC v. Ramirez, a case involving the federal Fair Credit Reporting Act.

The U.S. Court of Appeals for the First Circuit and federal and state courts in Massachusetts decided several important cases for the consumer financial services industry in 2021. Two related cases concerned the constitutionality of a Massachusetts regulation limiting telephone contact with debtors and a third ruling came from the First Circuit on a federal TCPA action.