The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing. In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own. A copy of the opinion is available at: Link to Opinion The borrowers obtained their mortgage loan in 2006. Attached…

Posts tagged as “Mortgage Law”

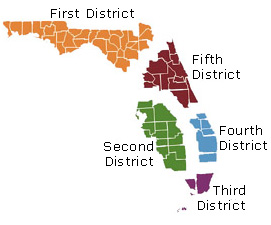

The Florida Fifth District Court of Appeal recently reversed a final judgment of foreclosure in favor of a mortgagee, holding that the mortgagee failed to prove it had standing to sue. In so ruling, the Fifth DCA also held that failure to provide at least 30 days to cure the default in the mortgagee’s notice of default and right to cure did not prejudice the borrower, and therefore did not constitute a valid defense to the foreclosure. A copy of the opinion is available at: Link to Opinion. A corporate borrower and its principal signed a promissory note and mortgage securing…

The Florida Fourth District Court of Appeal recently held that the priority between two assignees of notes secured by the same mortgage due to fraud is determined by Article 9 of the Uniform Commercial Code and not the recording statute applicable to assignments of mortgage. The Court held that the transferee that first perfected its interest in a note and related mortgage is entitled to the priority of its interest. A copy of the opinion is available at: http://www.4dca.org/opinions/May%202015/05-06-15/4D13-3193.op.pdf. In April 2006, a borrower obtained a loan and signed a mortgage securing the loan. At closing, the borrower signed two almost identical notes for…

The New York Court of Appeals, the state’s highest court, recently held that the statute of limitations does not bar an action to cancel a mortgage based upon a forged deed. A copy of the opinion is available here. The plaintiff was the administrator of her deceased father’s estate. The decedent and his sister (the “aunt”) inherited from their mother a house in Brooklyn as tenants-in-common. Several years later, in May 2000, the aunt executed a quitclaim deed conveying her one-half interest in the property to her daughter (the “cousin”). In February 2001, the cousin recorded a corrective deed that purported to…