The Illinois Appellate Court, First District, recently affirmed the dismissal of a borrower’s petition seeking to vacate a default judgment and order approving sale entered in a mortgage foreclosure action, holding that the borrower waived proper service of the foreclosure complaint. A copy of the opinion is available at: Link to Opinion. The mortgagee sued to foreclose its mortgage under the Illinois Mortgage Foreclosure Law in November 2011. The borrower was served by substitute service shortly thereafter and, approximately five months thereafter, the mortgagee moved for entry of a default. The borrower appeared at the hearing on the mortgagee’s motion for default,…

Posts tagged as “Foreclosure”

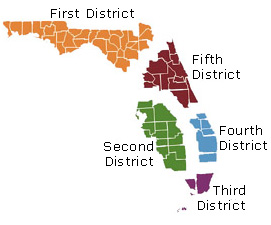

The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing. In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own. A copy of the opinion is available at: Link to Opinion The borrowers obtained their mortgage loan in 2006. Attached…

The Florida Fifth District Court of Appeal recently reversed a final judgment of foreclosure in favor of a mortgagee, holding that the mortgagee failed to prove it had standing to sue. In so ruling, the Fifth DCA also held that failure to provide at least 30 days to cure the default in the mortgagee’s notice of default and right to cure did not prejudice the borrower, and therefore did not constitute a valid defense to the foreclosure. A copy of the opinion is available at: Link to Opinion. A corporate borrower and its principal signed a promissory note and mortgage securing…

In Bank of America v. Alvarado, BER-F-47941-08 (January 7, 2011), Alvarado obtained a mortgage loan from Washington Mutual in 2006. After the loan was closed, Washington Mutual lost the note. It made an Affidavit of Lost Note dated July 14, 2006. Ownership of the mortgage loan, which included the Affidavit of Lost Note, was subsequently assigned to LaSalle Bank, as a trustee of a pool of mortgage loans. LaSalle Bank was then acquired in a merger by Bank of America. When the loan defaulted in 2008, Bank of America commenced a foreclosure action. Alvarado defended the foreclosure action on the…