On March 24, Utah Gov. Spence Cox signed into law SB 227, the Utah Consumer Privacy Act. This makes Utah the fourth state, behind California, Virginia, and Colorado, to enact comprehensive consumer data privacy legislation.

Posts tagged as “compliance”

In an update to an article we published earlier this week regarding the three major credit reporting agencies Equifax, Experian and TransUnion issuing a joint statement last week regarding how medical debt will be treated and reported on consumer credit reports, those agencies provided further clarification to data furnishers on March 22.

In just a few weeks several provisions of the New York Consumer Credit Fairness Act (NYCCFA) will take effect.

In a year that is still quite young, medical debt continues to find its way into the headlines of the receivables management industry. Continuing the trend, this past Friday, March 18, saw the three major credit reporting agencies Equifax, Experian and TransUnion issue a joint statement regarding how medical debt will be treated and reported on consumer credit reports.

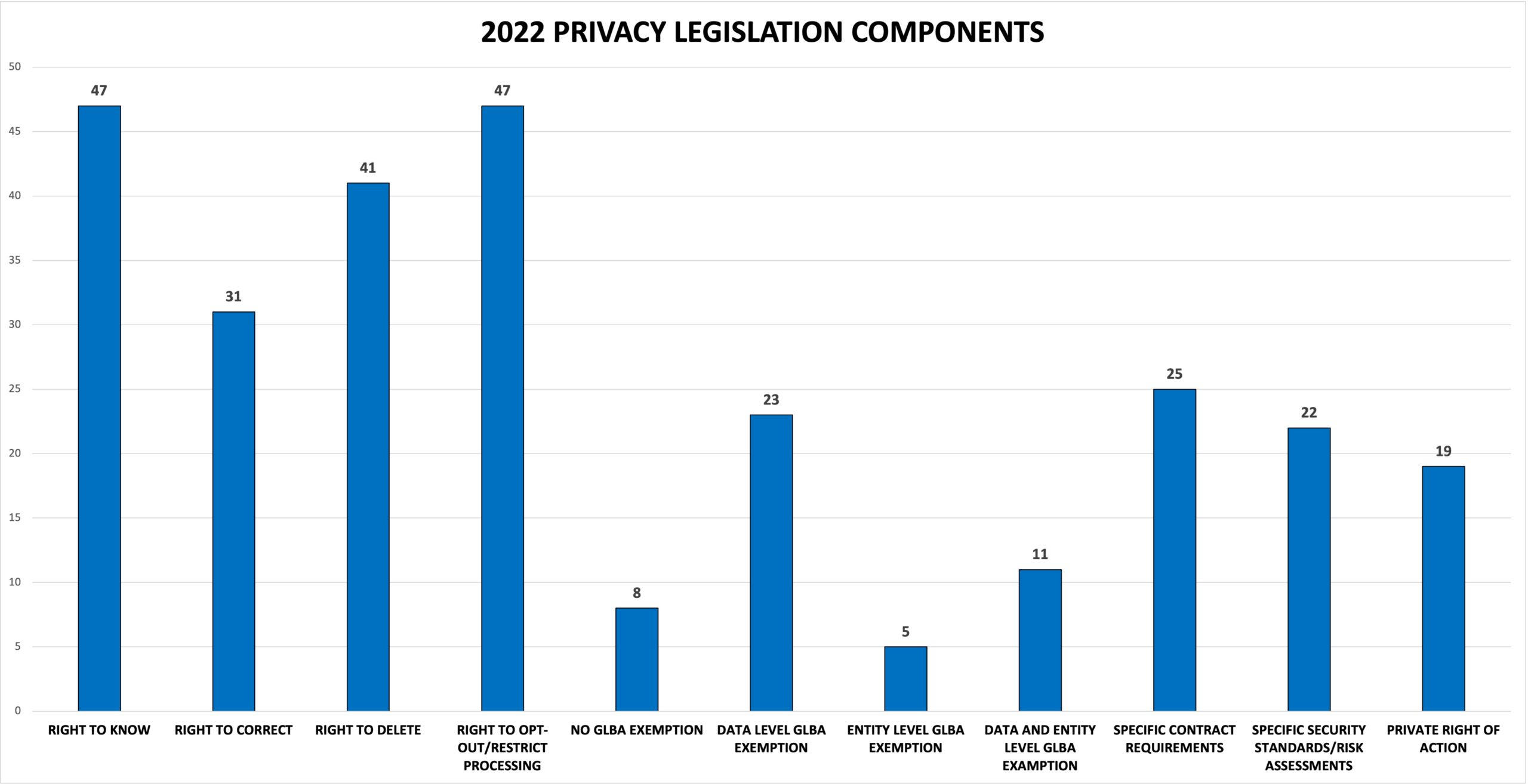

There are currently over 40 comprehensive consumer data privacy bills pending in the states as we enter the third month (for most states) of the legislative sessions.

Another auto lender recently agreed to pay millions of dollars to resolve allegations made by the Massachusetts Office of the Attorney General that it failed to provide compliant deficiency notices following the repossession of automobiles from consumers within the Commonwealth.

The Federal Trade Commission recently amended the Safeguards Rule, 16 C.F.R. § 314.1, et seq., with significant changes to how an information security program should be designed, what it must include, and who needs to be in charge.

The U.S. District Court for the Eastern District of Pennsylvania on Feb. 7 handed down a decision finding that the mere use of a letter vendor is sufficient to allege a violation of 15 U.S.C. § 1692c(b) of the Fair Debt Collection Practices Act by transmitting information to the letter vendor.

The Consumer Financial Protection Bureau increased the maximum civil penalty it can impose within its jurisdiction after Jan. 15, 2022. The increases are mandated by federal law, which requires agencies to adjust for inflation each civil monetary penalty within an agency’s jurisdiction by Jan. 15, 2022.

Federal courts have recently dismissed a number of cases brought by consumers alleging violations of consumer protection law because they lack “standing.” The trend has been hastened by the U.S. Supreme Court’s decision last year in TransUnion LLC v. Ramirez, a case involving the federal Fair Credit Reporting Act.

The U.S. Court of Appeals for the First Circuit and federal and state courts in Massachusetts decided several important cases for the consumer financial services industry in 2021. Two related cases concerned the constitutionality of a Massachusetts regulation limiting telephone contact with debtors and a third ruling came from the First Circuit on a federal TCPA action.