FCC Chairman Tom Wheeler’s TCPA “Fact Sheet” on forthcoming declaratory rulings issues should scare the heck out of any business using any telephone to reach potential, current or former customers. I believe the rulings will have a substantial impact on customer operations in the financial services industry. I expect the Declaratory Rulings to touch a number of crucial issues driving TCPA litigation. So I’ve assembled a team of seasoned TCPA litigators to talk with you on Monday, June 22 June 29, on how these declaratory rulings will affect the risks of using telephone technology. Here are the hot issues I expect the ruling to…

The FTC and the Office of the New York State Attorney General will host a “Debt Collection Dialogue,” aimed to be a conversation between government and business regarding consumer protection issues within the debt collection industry, in Buffalo, NY, on June 15. FTC Bureau of Consumer Protection Director Jessica Rich and New York State Attorney General Eric Schneiderman will deliver opening remarks. The afternoon program will be held at SUNY Buffalo State and will include a break and a Q&A period. Topics for discussion include recent enforcement actions, compliance issues, and consumer complaints regarding debt collection practices. The event will be the first…

The U.S. Supreme Court recently held that a debtor in a Chapter 7 case cannot “strip-off” or void a wholly unsecured junior mortgage under section 506(d) of the Bankruptcy Code. A copy of the opinion is available at: Link to Opinion. The debtors in the consolidated cases both had two mortgages on their homes. The petitioner held a second-position mortgage on each of the homes. The senior mortgage on each home exceeded its fair market value, meaning that the junior mortgages were entirely unsecured and “underwater.” Each debtor moved to “strip-off” or void the junior mortgage liens pursuant to section 506(d)…

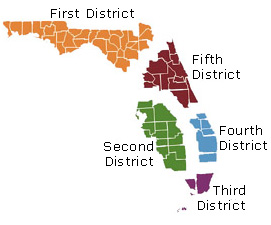

The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing. In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own. A copy of the opinion is available at: Link to Opinion The borrowers obtained their mortgage loan in 2006. Attached…

The U.S. Court of Appeals for the Second Circuit recently affirmed the denial of a motion to dismiss a putative class action, holding that the named plaintiff’s individual claims were not rendered moot by an unaccepted offer of judgment under Federal Rule of Civil Procedure 68. This case was decided before the U.S. Supreme Court granted certiorari in Campbell-Ewald Company v. Gomez on May 18, 2015. Campbell-Ewald should address in part whether a case should be dismissed when the plaintiff receives an offer of complete relief on his claim, and whether this rule should be any different if the plaintiff has asserted a class…

The Florida Fifth District Court of Appeal recently reversed a final judgment of foreclosure in favor of a mortgagee, holding that the mortgagee failed to prove it had standing to sue. In so ruling, the Fifth DCA also held that failure to provide at least 30 days to cure the default in the mortgagee’s notice of default and right to cure did not prejudice the borrower, and therefore did not constitute a valid defense to the foreclosure. A copy of the opinion is available at: Link to Opinion. A corporate borrower and its principal signed a promissory note and mortgage securing…

Collecting statutory prejudgment interest in California did not violate the Fair Debt Collection Practices Act, under a decision earlier this month from the Ninth Circuit Court of Appeals. The decision, Diaz v Kubler, rejected the debtor’s contention that interest allowed by a California statute could not be collected unless a judgment was first entered. Decision Has Limited Impact While the decision brings clarity when collecting prejudgment interest in California, it does not authorize the collection of prejudgment interest under other state statutes. Last year, the Sixth Circuit Court of Appeals found that a debt buyer’s collection of prejudgment interest under…

FCC Chairman Tom Wheeler announced Wednesday that the FCC will move to protect consumers from unwanted robocalls and texts like never before by proposing new standards for TCPA regulation that will be voted on next month. Establishing new rules, closing loopholes, and simplifying the opt-out process for consumers are the three main goals of the proposal, which Wheeler calls “yet another win for consumers.” The FCC considers this proposal to be one of the most significant consumer protection actions since it helped to establish the Do-Not-Call Registry in 2003. The crackdown on robocalls, texts, and telemarketer calls; the number one source of…

The U.S. Court of Appeals for the Seventh Circuit recently held that a secured creditor must file its proof of claim no later than the 90-day deadline under Federal Rule of Bankruptcy Procedure 3002(c) in order to receive distributions under a Chapter 13 plan of reorganization. A copy of the opinion is available here: Link to Opinion. An individual debtor filed his petition under Chapter 13 of the Bankruptcy Code. The clerk of the Bankruptcy Court mailed the “Notice of Chapter 13 Bankruptcy Case, Meeting of Creditors, & Deadlines” to the debtor’s creditors. Pursuant to Federal Rule of Bankruptcy Procedure 3002(c),…

The Florida Third District Court of Appeal recently reversed a trial court’s order dismissing a mortgage foreclosure action with prejudice and cancelling the note and mortgage as a sanction, focusing on the mortgagee’s failure to amend the complaint and withdraw two affidavits filed in support of the allegedly “lost” note claim when it had later found the original note. A copy of the opinion is available here. The plaintiff mortgagee sued to foreclose its mortgage in May 2009 after the borrower defaulted. The complaint contained a claim to re-establish the lost note. However, more than two years after the case was…

The U.S. District Court for the Northern District of California recently denied a motion to compel arbitration filed by two allegedly affiliated banks that issued department store credit cards, and the one of the issuing banks and another entity that serviced the cards, in a case alleging they violated the federal Telephone Consumer Protection Act by calling the debtor’s cellular phone in an attempt to collect on the credit card debt. A copy of the opinion is available here. The plaintiff stopped paying his credit card in July 2013 and sent a letter to the issuing bank advising that he could no longer make payments and…

The Florida Fourth District Court of Appeal recently held that the priority between two assignees of notes secured by the same mortgage due to fraud is determined by Article 9 of the Uniform Commercial Code and not the recording statute applicable to assignments of mortgage. The Court held that the transferee that first perfected its interest in a note and related mortgage is entitled to the priority of its interest. A copy of the opinion is available at: http://www.4dca.org/opinions/May%202015/05-06-15/4D13-3193.op.pdf. In April 2006, a borrower obtained a loan and signed a mortgage securing the loan. At closing, the borrower signed two almost identical notes for…