The U.S. Court of Appeals for the Third Circuit recently held that a false statement in a communication from a debt collector must be “material” to be actionable under the FDCPA. In so ruling, the Court found that materiality was a part of the “least sophisticated debtor” analysis. A copy of the opinion is available at: Link to Opinion. In that case, a debt collector had purchased credit-card debt from the original lender. That debt collector then hired a law firm to help collect the debt. The law firm then filed suit to collect the debt. In that underlying case, the law…

The United States Bankruptcy Appellate Panel for the Eighth Circuit recently held that filing a proof of claim on a time-barred debt is not, alone, a prohibited debt collection practice under the federal Fair Debt Collection Practices Act. A copy of the opinion is available at: Link to Opinion. Husband and wife debtors filed a Chapter 13 bankruptcy petition. A medical services provider filed a proof of claim shortly thereafter. After their Chapter 13 plan was confirmed, the debtors filed an adversary proceeding against the medical services provider for damages under the FDCPA, arguing that because the debt was time…

A QR code visible on the face of an envelope embedded with an account number violates the Fair Debt Collection Practices Act, according to a recent decision from the United States District Court for the Middle District of Pennsylvania. A QR or “Quick Response” code is a type of bar code that can contain any sort of information. But the information is not visible, instead the QR code looks more like a jumble of black and white lines or boxes. You can’t do much with a QR code unless you have a device that can read the code. QR Codes…

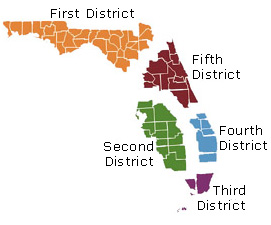

The Florida Second District Court of Appeal recently affirmed a trial court’s order granting a new trial on the issue of damages in a mortgage foreclosure action, holding that a payment history authenticated by the successor loan servicer was admissible under the business records exception to the hearsay rule because the successor servicer independently verified the accuracy of the payment history received from the prior servicer and explained the procedures used to verify the prior servicer’s loan records. A copy of the opinion is available at: Link to Opinion. This was the second appeal in the same foreclosure action. In…

The Consumer Financial Protection Bureau and Department of Justice recently entered into a Consent Order with an automobile finance company for alleged violations of the federal Equal Credit Opportunity Act, 15 U.S.C. §§ 1691 (ECOA), arising from the auto finance company’s policies and practices allowing car dealer discretion for interest rate markups. A copy of the consent order is available at: Link to Consent Order. A copy of the related DOJ complaint is available at: Link to Complaint. In connection with sales of cars on credit, car dealers frequently submit credit applications to auto finance companies on behalf of their…

The Consumer Financial Protection Bureau has issued its final rule confirming the delay of the effective date of the TILA-RESPA Integrated Disclosures (TRID) rule to Oct. 3, 2015. A copy of the final rule is available at: Link to Final Rule. The final rule also makes certain technical corrections, including: Amending 12 CFR § 1026.38(i)(8)(ii) and (iii)(A) to “include, in the amount disclosed as ‘Final’ for Adjustments and Other Credits, the amount disclosed under § 1026.38(j)(1)(iii) for certain personal property sales, thus conforming the calculation of Adjustments and Other Credits on the Closing Disclosure and Loan Estimate;” and Amending 12 CFR…

A recent decision found there’s a difference between advertising and telemarketing messages under the TCPA and that difference may have created a horror story for one movie promoter under the decision from the Eighth Circuit Court of Appeals. “Liberty. This is a public survey call. We may call back later,” was the prerecorded message left twice on the voicemails of plaintiffs Ron and Dorit Golan. The calls, if answered, would have also played a 45-second scripted message that included a survey and promotional material about the movie. However, because the plaintiffs did not answer the calls, they only heard the short message regarding…

The Court of Appeals of New York recently held that a mortgage loan repurchase action for breach of representations and warranties accrued when the representations and warranties were made, and the obligation to cure and repurchase was not a separate and continuing promise of future performance. A copy of the opinion is available at: Link to Opinion. The sponsor of a residential mortgage-backed securities trust purchased 8,815 mortgage loans from third-party originators. This pool of loans was sold to an affiliate, known as a “depositor,” pursuant to a Mortgage Loan Purchase Agreement (MLPA) between the sponsor and the depositor dated…

The U.S. Court of Appeals for the Ninth Circuit recently affirmed a district court’s dismissal of a borrower’s claims for breach of contract and breach of fiduciary duty relating to alleged failures to properly disburse escrow amounts against a non-servicer assignee of a mortgage loan. In so ruling, the Court confirmed that Washington does not bar splitting the loan servicing duties from the right to receive payment under the note. A copy of the opinion is available at: Link to Opinion. The deed of trust between the borrower and the loan originator required the borrower to pay the hazard insurance…

The U.S. Court of Appeals for the Eleventh Circuit recently affirmed the dismissal of a borrower’s allegations under the federal Fair Debt Collection Practices Act and the Florida Consumer Collection Practices Act as to one letter, the purpose of which was to request additional information, but reversed as to two other letters, holding that they were sent in connection with the collection of a debt. A copy of the opinion is available at: Link to Opinion. The plaintiff’s mortgage loan went into default and the law firm representing the lender sent the borrower three letters. Two weeks later, the borrower…

The U.S. Court of Appeals for the Fourth Circuit recently reversed the dismissal of a Chapter 13 bankruptcy debtor’s complaint filed in federal district court alleging that defendants foreclosed on and sold the debtor’s home in violation of the automatic stay, holding that the federal district court had subject matter jurisdiction and the complaint adequately stated a plausible claim for relief under 11 U.S.C. § 362(k). In so ruling, the Court held that 11 U.S.C. § 362(k), which created a private right of action for damages for willful violation of the stay, may be filed in federal district court because…

Yesterday I commented on a recent decision from the Eleventh Circuit Court of Appeals, Miljkovic v. Shafritz and Dinkin, P.A. et al., noting it spelled trouble for attorneys engaged in debt collection. Miljkovic incorrectly construes the Fair Debt Collection Practices Act and its legislative history as well as two U.S. Supreme Court cases, to arrive at the mistaken conclusion that attorney litigation activity is regulated by the FDCPA, except for one minor exemption. Hours later, a trial court sitting in the Eleventh Circuit handed down a decision in CFPB v. Frederick J. Hanna & Associates, P.C., et al., which allows the Consumer Financial Protection…