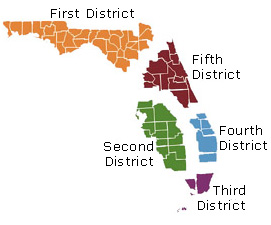

The District Court of Appeal of Florida for the Fifth District recently held that a trial court’s refusal to extend the duration of a lis pendens on real property was a departure from the essential requirements of law. A copy of the opinion is available at: http://www.5dca.org/Opinions/Opin2015/042715/5D14-4009.op.pdf Due to a scrivener’s error by the closing agent, the real property that was supposed to have secured a loan was not encumbered by the mortgage. The lender sued to reform the loan documents and foreclose or, in the alternative, to impose an equitable lien against the subject property. The lender moved to extend…

The U.S. Court of Appeals for the First Circuit recently dismissed a borrower’s appeal as moot because the borrower and loan servicer entered into a loan modification agreement while the appeal was pending, meaning the borrower was no longer subject to any actual or threatened foreclosure proceedings. A copy of the opinion is available at: Link to Opinion In 2005, the borrower obtained a $200,000 loan secured by a mortgage on her home. The mortgage was assigned twice, the last one to a bank as trustee. The first assignee, to whom the note was transferred along with the mortgage, endorsed…

The US. Court of Appeals for the Ninth Circuit recently reversed a district court’s order remanding a class action to state court, holding that a second removal was proper and timely-filed 30 days after the state court entered an order that expanded the class definiton after the first removal. A copy of the opinion is available at: http://cdn.ca9.uscourts.gov/datastore/opinions/2015/04/01/15-55176.pdf The plaintiff, an assistant store manager at a nationwide chain of discount retail stores, filed this action in state court in July of 2012, alleging that the employer supposedly violated the California Labor Code by denying 10-minute rest breaks to its employees. As…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure, holding that the mortgagee failed to properly establish the amount of its damages. However, the Appellate Court further held that because the borrower failed to move for dismissal at the close of evidence, the proper remedy was reversal and remand, rather than involuntary dismissal. A copy of the opinion is available at: Link to Opinion A mortgagee filed a foreclosure action against the borrowers in early 2009. Ultimately, the case was tried in November of 2013. It was undisputed at trial that the mortgagee had standing as the…

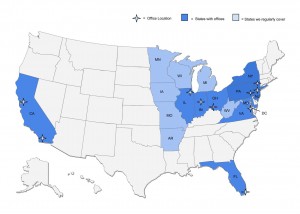

You may have noticed a new firm logo on our site. I’m very happy to announce the merger of Maurice & Needleman with financial services law firm McGinnis Wutscher. The alliance enables us to provide the services of 24 lawyers in 10 offices in the Northeast, Southeast, Midwest and West. We now have offices in Chicago, Cincinnati, Indianapolis, Miami, San Diego, San Francisco and Washington in addition to New York, Flemington and Philadelphia. As Maurice Wutscher, the firm will focus in the areas of consumer credit defensive litigation, commercial banking litigation, regulatory compliance, insurance recovery and advisory services, professional liability defense and ethics matters. The lawyers of…

New York’s Department of Financial Services published regulations on Dec. 3, 2014, which would require debt collectors to make additional disclosures to consumers following initial communications, provide consumers who dispute charged-off debt with certain information, adopt procedures concerning the applicability of statutes of limitations, maintain certain records and provide written confirmation of settlements, among other things. The regulations (available here) are applicable to third-party debt collectors (those who collect debts owed to others) and debt-buyers. On Jan. 15, I’ll be discussing the regulations in a DBA International webinar Working with New York’s Latest Debt Collection Regulations (register here). In the meantime, here is a closer look at the regulations. Who…

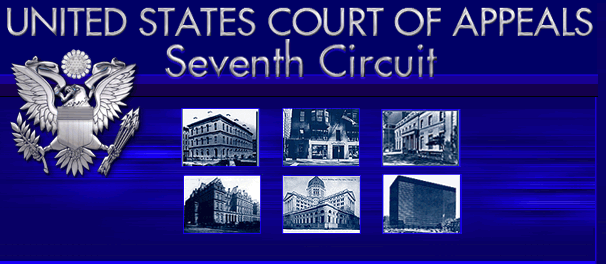

Like the 80 inches of snow that pummeled Buffalo this week, the crusade against time-barred debt continues to hammer the collection industry. Today the United States Court of Appeals for the Seventh Circuit denied a petition for leave to file an interlocutory appeal in the matter of Patrick v. PYOD, LLC. Earlier this summer, a judge sitting in the United States District Court for the Southern District of Indiana denied a collector’s motion to dismiss an FDCPA complaint based on the filing of a proof of claim on a debt that was beyond the statute of limitations. Relying on Randolph v.…

It has been several months since the Eleventh Circuit handed down its decision holding that filing a proof of claim on “time-barred” debt violates the FDCPA. The request for rehearing, which I reported about this past summer, was denied. While a petition for certification to the Supreme Court is possible, even if the court accepts the case (and that’s a tall order itself) we would not see a decision before 2016. A Multitude of Crawford-type Claims While it was a safe bet a new round of FDCPA claims would be spawned by Crawford, the sheer number of claims being filed outside the Eleventh Circuit is surprising.…

The Federal Trade Commission has posted seven steps debt brokers should follow to keep data secure on the Bureau of Consumer Protection’s Business Center Blog. This latest guidance comes after the FTC requested that a federal court order two debt brokers that exposed the personal information of more than 70,000 consumers online to notify the consumers and give them direction on how to protect themselves against fraud and identity theft. According to the FTC, two debt brokers violated the FTC Act when they placed the personal information of the consumers, including bank account and credit card numbers, birth dates, employment information and more, on a…

The GOP victory in yesterday’s mid-term elections probably will not translate into any immediate relief for the consumer financial services industry. But if you are looking for any sign of where things might be heading, know that voters handily rejected many candidates Sen. Elizabeth Warren, the unofficial founder of the Consumer Financial Protection Bureau, stumped for this election cycle. Martha Coakley, the Massachusetts Attorney General, spent the last few years promulgating some of the most restrictive debt collection regulations in the nation. Warren was a frequent campaign companion, but it didn’t help Coakley in the end, she lost her bid…

If I did not read this opinion I never would have believed it. In one of the greatest examples of baiting a collector into a violation of the FDCPA, a plaintiff in Missouri decided he was not going to wait for a collector to call him and instead called the collector himself to induce a 1692c(a)(2) violation. According to the opinion, “In mid-June 2014 plaintiff retained an attorney to represent him regarding his debts, including those which defendants are attempting to collect from him. Shortly after retaining legal counsel plaintiff phoned defendant MRG to ask about the debt and to inform…

With its decision in Crawford v. LVNV Funding, LLC still leaving a bad taste in the collection industry’s mouth, the Eleventh Circuit has provided some solace to the financial services industry with its decision in Mais v. Gulf Coast Collection Bureau, Inc., No. 13-14008 (11th Cir. Sept. 29, 2014). The key holding was the reversal of the district court’s interpretation of “prior express consent” under the Telephone Consumer Protection Act. Plaintiff sued the medical service provider and its debt collection agent for making autodialed or prerecorded calls to his cellular telephone in violation of the TCPA. His wife had given his cellular telephone…