The United States District Court for the District of Massachusetts recently held that the federal Fair Credit Reporting Act (FCRA) preempts Massachusetts state law claims for violations of the Massachusetts Credit Reporting Act, Mass. Gen. Laws ch. 93, § 54A, and the Massachusetts Consumer Protection Act, Mass. Gen. Laws ch. 93A. The decision also held that the mere furnishing of information following a bankruptcy discharge, without more, is not actionable. A copy of the opinion is available at: Link to Opinion. The decision adds to a growing split among federal courts on both issues. Credit Reporting a Loan Modification and…

Posts published in September 2015

The U.S. Court of Appeals for the Seventh Circuit recently affirmed summary judgment in favor of a debt collector, holding among other things that the “FDCPA is not an enforcement mechanism for matters governed elsewhere by state and federal law.” A copy of the opinion is available at: Link to Opinion. The plaintiff failed to pay his credit card and a law firm specializing in debt collection sued to collect the balance in state court. In response to the creditor’s motion for summary judgment, the card holder invoked the arbitration provision in the credit card agreement. The state court denied…

The Illinois Appellate Court, Third District, recently affirmed a grant of summary judgment to a mortgagee over the borrowers’ standing and hearsay challenges. In so ruling, the Appellate Court held that: (1) the mortgagee’s failure to attach a copy of the note with the indorsement in blank to the complaint did not deprive it of standing; and (2) an affidavit by an employee of the current holder of the debt was admissible in a foreclosure proceeding even though some of the business records were created by a prior entity. A copy of the opinion is available at: Link to Opinion.…

The District Court of Appeal of Florida, Fifth District, recently reversed the denial of a motion for deficiency judgment in a foreclosure action, holding that the trial court erroneously required the mortgagee to introduce into evidence the final judgment of foreclosure previously entered in the same case to demonstrate the amount of debt owed. A copy of the opinion is available at: Link to Opinion. The trial court granted summary judgment of foreclosure in favor of the mortgagee, specifically reserving jurisdiction to enter further orders, including deficiency judgments. The borrower did not appeal the judgment of foreclosure. The mortgagee then…

SD Fla. Provides Mixed Ruling on RESPA RFI Responses, Property Inspection Fees Assessed Post-Default

The U.S. District Court for the Southern District of Florida recently dismissed with prejudice a borrowers’ allegations that a loan servicer’s response to their request for information regarding drive-by property inspections violated the federal Real Estate Settlement Procedures Act (RESPA), and dismissed the remaining state-law allegations that the drive-by inspections violated the Florida Consumer Collection Practices Act (FCCPA) for lack of subject matter jurisdiction. A copy of the opinion is available here: Link to Opinion. The borrowers defaulted on their home mortgage loan. The loan servicer began conducting drive-by inspections pursuant to the mortgage. The borrowers sent a letter to the…

The U.S. Court of Appeals for the Seventh Circuit recently affirmed a district court’s judgment that a lender did not owe the borrower a fiduciary duty to use the payout from a homeowners’ insurance policy to pay down the loan instead of repair the house, but reversed the dismissal of the borrower’s breach of contract claim. A copy of the opinion is available at: Link to Opinion. The borrower purchased his home in 2005 with a $100,500 mortgage loan. The home was seriously damaged by a fire five years later. The borrower filed an insurance claim, and the insurer paid…

The Illinois Appellate Court, First District, recently affirmed a grant of summary judgment allowing a lender to foreclose its mortgage, even though it may not have complied with certain provisions in the federal Truth in Lending Act (TILA). In so ruling, the Appellate Court found that TILA did not apply because the loan at issue was a commercial loan, not a consumer loan, even though the loan was secured by the borrower’s principal residence. A copy of the opinion is available at: Link to Opinion. The husband borrower owned a business that purchased tax certificates. This business had a $2.3…

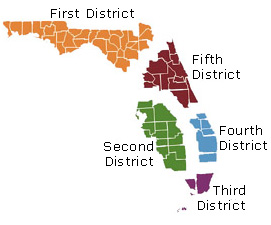

The District Court of Appeal of the State of Florida for the First District recently held that the statute of limitations does not bar a second mortgage foreclosure action based on a subsequent default, regardless of whether the first case was dismissed with or without prejudice. A copy of the opinion is available at: Link to Opinion. The borrowers defaulted on their mortgage in February of 2007. In April of 2007, the plaintiff mortgagee’s predecessor in interest accelerated the note based on the February, 2007 breach and sued to foreclose the mortgage. The case was dismissed without prejudice in October…

The U.S. Court of Appeals for Eleventh Circuit recently held that a municipality has standing to bring disparate impact discrimination claims under the federal Fair Housing Act to recover for allegedly increased police, fire and other costs supposedly caused by the defendant banks’ so-called “predatory lending” practices. A copy of the opinion is available at: Link to Opinion. The City brought three separate cases against three different banks, alleging that they violated the Fair Housing Act, 42 U.S.C. § 3601 et seq. (FHA), by supposedly targeting Black and Latino customers for so-called “predatory” loans that were allegedly riskier and had…

The U.S. Court of Appeals for the Fifth Circuit recently held that an unaccepted offer of judgment does not moot a lead plaintiff’s claim in a putative class action. In so ruling, the Fifth Circuit reversed the district court’s ruling that, because a motion for class certification was not filed before the offer, the putative class action was also mooted. A copy of the opinion is available at: Link to Opinion. The plaintiff withdrew money from his checking account at an automated teller machine (ATM) and subsequently sued the ATM owner, seeking statutory damages under the Electronic Funds Transfer Act…

The U.S. Court of Appeals for the Third Circuit recently held that the Federal Trade Commission (FTC) has the legal authority under section 45(a) of the Federal Trade Commission Act (FTC Act) to regulate cybersecurity as an “unfair” act or practice affecting interstate commerce. In so ruling, and among other things, the Court rejected the defendants’ argument that the FTC did not provide “fair notice” of the cybersecurity requirements it was seeking to impose, holding that a company is “not entitled to know with ascertainable certainty the FTC’s interpretation of what cybersecurity practices are required by § 45(a), … as…

The U.S. Court of Appeals for the Ninth Circuit recently held that the district court abused its discretion in denying a plaintiff’s motion to certify a class of home buyers alleging that a scheme involving a title insurer buying minority interests in title agencies in exchange for referral of future title insurance business violated the federal Real Estate Settlement Procedures Act (RESPA), affirming in part, vacating in part and remanding for further proceedings. In so ruling, the Court held that the Consumer Financial Protection Bureau’s position in its amicus brief was not entitled to Chevron deference, because the CFPB was…