The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing.

The Florida Second District Court of Appeal recently reversed a trial court’s dismissal of a mortgage foreclosure action because the plaintiff bank was the proper party to sue and proved that it had standing.

In so ruling, the Second DCA applied its prior ruling allowing “incorporation” or “adoption” of a prior servicer’s records, which essentially allows a subsequent servicer to use a prior servicer’s records if the subsequent servicer verified the prior servicer’s records before using them as its own.

A copy of the opinion is available at: Link to Opinion

The borrowers obtained their mortgage loan in 2006. Attached to the note was an allonge bearing a blank endorsement.

The borrowers defaulted and sometime thereafter the note was assigned to a third-party entity (the “assignee”), who sued to foreclose the mortgage in 2008. The complaint included a count to reestablish a lost note, and included a copy of the mortgage.

In 2012, the assignee filed an amended verified complaint after the trial court granted its motion to amend. The Appellate Court did not elaborate how the substitution of parties occurred.

The case went to trial and the judge entered final judgment in favor of the borrowers, because it determined that the assignee was not a proper party and it lacked standing. The assignee appealed.

The Second DCA began its analysis by reiterating the “black letter law” in Florida that a plaintiff who is not the original lender can establish standing to foreclose by submitting a note with a blank or special endorsement, an assignment of the note, or an affidavit otherwise proving the plaintiff’s status as holder of the note. In addition, the Court noted that standing must be established as of the time the foreclosure complaint is filed.

The Court found that the assignee, although not the original lender, proved that it was the holder of the note and mortgage when the amended complaint was filed because it submitted the note with a blank endorsement. Nothing more was required to prove standing, and the Court reversed the final judgment on this basis alone.

The Court went on address the trial court’s exclusion of the testimony of the bank’s witness as hearsay because it did not fall within the business records exception to the hearsay rule.

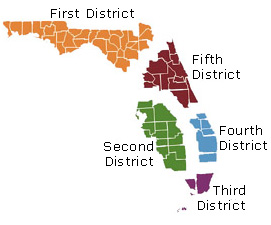

The Second DCA concluded that the trial court erred in relying on a decision from the Fourth District Court of Appeals, Glarum v. LaSalle Bank Natl. Ass’n, 83 So. 3d 780 (Fla. 4th DCA 2011).

Instead, the case was controlled by the Second DCA’s earlier decision in WAMCO XXVII, Ltd. V. Integrated Electronic Environments, Inc., 902 So. 2d 230 (Fla. 2d DCA 2005), in which the Second DCA held that testimony that relied in part on records received from a prior servicer were not inadmissible hearsay, when the current foreclosure plaintiff’s witness testified as to how the prior servicer’s records were entered into the current plaintiff’s systems, how the current plaintiff verified the accuracy of the prior servicer’s records, and that the current plaintiff relied on the prior servicer’s records after verifying their accuracy.

Here, because the assignee’s witness testified in detail about the procedures the loan servicer for whom he worked used, as well as about his personal experience with the type of loan at issue, the Second DCA held that the evidence was admissible as a business record.

Accordingly, the trial court’s judgment against the assignee was reversed, and the case remanded for a new trial.