Insufficient data protection or information security can violate the prohibition against unfair acts or practices according to a circular released last week by the federal Consumer Financial Protection Bureau.

Posts published in “CFPB”

Consumer Financial Protection Bureau

The federal Consumer Financial Protection Bureau has issued an Advisory Opinion on "convenience" or "speed pay" fees, such as "fees imposed for making a payment online or by phone," under the federal Fair Debt Collection Practices Act.

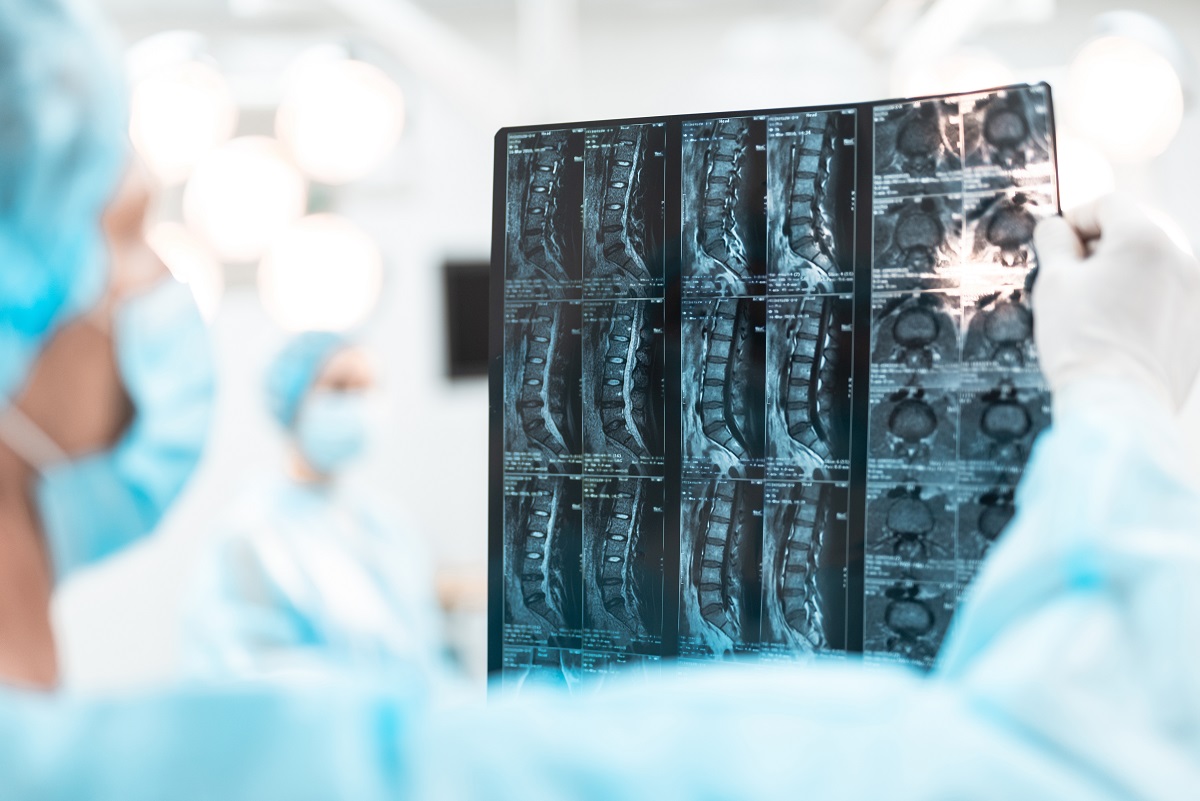

Medical debt continues to dominate the headlines in 2022 and continues to be an area of significant focus for the Consumer Financial Protection Bureau.

The U.S. Court of Appeals for the Eleventh Circuit recently vacated a trial court’s ruling granting summary judgment in favor of a mortgage servicer and against the federal Consumer Financial Protection Bureau (“CFPB”) based on res judicata.

The Consumer Financial Protection Bureau increased the maximum civil penalty it can impose within its jurisdiction after Jan. 15, 2022. The increases are mandated by federal law, which requires agencies to adjust for inflation each civil monetary penalty within an agency’s jurisdiction by Jan. 15, 2022.

The Consumer Financial Protection Bureau has proposed a rule it says would “shine new light on small businesses’ access to credit.” The proposed rule accomplishes this goal by requiring lenders to “disclose information about their lending to small businesses.”

The Consumer Financial Protection Bureau (CFPB) announced on July 30, 2021, that it will be withdrawing its earlier proposal to extend the Regulation F effective date by 60 days. Thus, the original effective date of Nov. 30, 2021, will remain.

The federal Consumer Financial Protection Bureau (CFPB) recently issued its final rule entitled “Protections for Borrowers Affected by the COVID-19 Emergency Under the Real Estate Settlement Procedures Act (RESPA), Regulation X.”

The U.S. Court of Appeals for the Third Circuit recently affirmed the dismissal of a class action complaint alleging that a collection letter’s itemization of a debt as including “$0.00” in interest and fees — when the debt could not accrue interest or fees — violated the federal Fair Debt Collection Practices Act.

On April 7, the Consumer Financial Protection Bureau (CFPB) issued a Proposed Rule that would postpone the effective date of the Debt Collection Final Rules, Part 1 and Part 2, by 60 days, from Nov. 30, 2021, to Jan. 29, 2022.

The Consumer Financial Protection Bureau increased the maximum civil penalty it can impose within its jurisdiction after Jan. 15, 2021. The increases are required by federal law, which requires agencies to adjust for inflation each civil monetary penalty within an agency’s jurisdiction by Jan. 15.