The U.S. Court of Appeals for the Eleventh Circuit recently held that a party challenging an arbitration agreement containing a delegation clause – requiring threshold determinations, such as whether an arbitration agreement is enforceable, to be made by an arbitrator – must challenge the delegation clause specifically, and not simply the agreement as a whole. A copy of the opinion is available at: Link to Opinion. The plaintiff, a Georgia resident, responded to a television advertisement for short-term loans by applying for the $1,000 loan using his computer. The lender was a South Dakota limited liability company located on Indian…

Posts published in November 2015

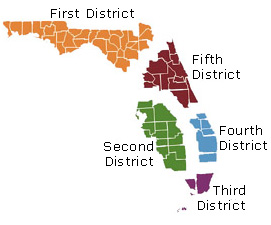

The District Court of Appeal of the State of Florida, Fifth District, recently reversed the entry of a judgment in favor of two borrowers in a foreclosure action, and confirmed that a current servicer does not need to present testimony from an employee of a prior servicer in order to admit the business records of the prior servicer into evidence at trial. A copy of the opinion is available at: Link to Opinion. The borrowers obtained their mortgage loan in 2006. They defaulted, and the prior servicer brought a foreclosure action in 2009. At that time, the borrowers sent a…

Bill targets collectors seeking repayment of government debt and debt buyers On Nov. 5, U.S. Senator Cory Booker introduced S. 2255, the “Stop Debt Collection Abuse Act of 2015.” Though primarily targeted toward debt collectors collecting on obligations owed to the federal government, the bill also brings debt buyers into the FDCPA definition of “debt collector.” The bill has been assigned to the Senate Banking Committee. Regarding private debt collectors under contract with the federal government: The definition of “debt” (15 USC 1692a(5)) is expanded to include “any obligation or alleged obligation of a consumer (i) to pay a loan,…

A New Jersey Senate bill introduced in 2014 relating to debt collectors’ responsibilities upon receipt of notice of identity theft or misidentification crossed over to the Assembly this week. S1344 received unanimous support in the Senate Commerce Committee, with amendments, and passed from the Senate on third reading by a vote of 32-0. The bill adopts the FDCPA’s definition of “debt,” but strays in its definition of “debt collector” which includes, in part, “any person who by any direct or indirect action, conduct, or practice, collects or attempts to collect a debt that is owed or due or asserted to…

The District Court of Appeal of Florida, Second District, recently reversed a final judgment of foreclosure where a substituted plaintiff failed to prove the original plaintiff had standing when suit was filed. In so ruling, the Appellate Court confirmed that it is not enough for a plaintiff to prove standing when the case is tried, it must also prove standing when the complaint was filed. A copy of the opinion is available at: Link to Opinion. A mortgagee initiated a residential foreclosure action after borrowers defaulted, and the borrowers responded that the mortgagee lacked standing. An assignee was then substituted…

The Consumer Financial Protection Bureau’s latest edition of Supervisory Highlights was released last week. I expected some stinging comments directed at debt collectors and debt buyers, given the recent consent decrees. What I found was the opposite. The 45-page report devoted only three paragraphs to supervised ARM entities. And, what was reported only indicates the potential for regulatory violation and did not note any instance where a consumer was actually harmed. Communications with Consumers Here the Bureau looked at supervised entities’ compliance with section 1692c of the Fair Debt Collection Practices Act. The CFPB’s beef here was that ARM companies had…

The federal Consumer Financial Protection Bureau (CFPB) recently released its Supervisory Highlights (Issue 9, Fall 2015), a copy of which is available here. The CFPB reported that, among other things, its “supervisory activities have either led to or supported six recent public enforcement actions, resulting in $764.9 million being returned to consumers and $50.7 million in civil money penalties,” plus supervisory resolutions resulting in “restitution of approximately $107 million to more than 238,000 consumers.” In addition, the CFPB provided a summary discussion of its fair lending and ECOA compliance examination methodologies, as well as a number of steps lenders may…

The Court of Appeal of the State of Florida, Fifth District, recently affirmed the dismissal of a check payee’s claims against the drawee bank for charging a fee to cash the check in person, holding that while section 655.85, Florida Statutes, prohibits the bank from charging such a fee, it does not create a private cause of action. However, the Court also held that federal law did not preempt the state “anti-check cashing fee” statute, even as applied to an out-of-state insured state bank. A copy of the opinion is available at: Link to Opinion. The payee of a check…

The Court of Appeal for the Third District of the State of Florida recently held that the trial court had subject matter jurisdiction to hear a common law action to recover a deficiency judgment after an earlier residential mortgage foreclosure action in the same court was already completed. The Court reasoned that the applicable statute expressly provided for such a common law action, and although the foreclosure judgment reserved jurisdiction to adjudicate any claim seeking a deficiency, it neither granted nor denied it. A copy of the opinion is available at: Link to Opinion. A mortgage loan servicer obtained a…

The U.S. District Court for the Middle District of Florida recently confirmed that Florida’s statute of limitations did not bar a mortgagee from filing a new foreclosure action based on non-payment or other kinds of defaults within the past five years, even where the prior foreclosure action was dismissed without prejudice and acceleration of the mortgage occurred more than five years prior to the second foreclosure action. In so ruling, the Court dismissed an amended complaint for declaratory judgment seeking to invalidate a mortgage. A copy of the opinion is available at: Link to Opinion. A property owner sought a…

Yesterday’s oral argument before the U.S. Supreme Court in Spokeo v. Robins suggests a struggle to fashion an understanding of what can constitute an “injury in fact.” It pitted the issue of whether a plaintiff’s standing to sue requires a tangible, concrete injury (loss of money, a job or property right) against the concept that the law can identify a “harm” (in this case, inaccurate information in a credit report) which itself is a real injury. Finding the Injury Spokeo v. Robins concerns an alleged violation of the Fair Credit Reporting Act. Robins claimed Spokeo compiled a report about him that contained false information…

The Second District Court of Appeal of the State of Florida recently affirmed an award of attorney’s fees and costs to two borrowers, even though the borrowers moved for fees and costs more than 30 days after the mortgagee filed a notice of voluntary dismissal that was expressly made conditional upon the parties “agreeing to pay their own attorneys’ fees and costs.” In so ruling, the Appellate Court confirmed that a conditional notice of voluntarily dismissal was ineffective to commence the 30-day period within which to move for attorney’s fees and costs under Florida law. A copy of the opinion…